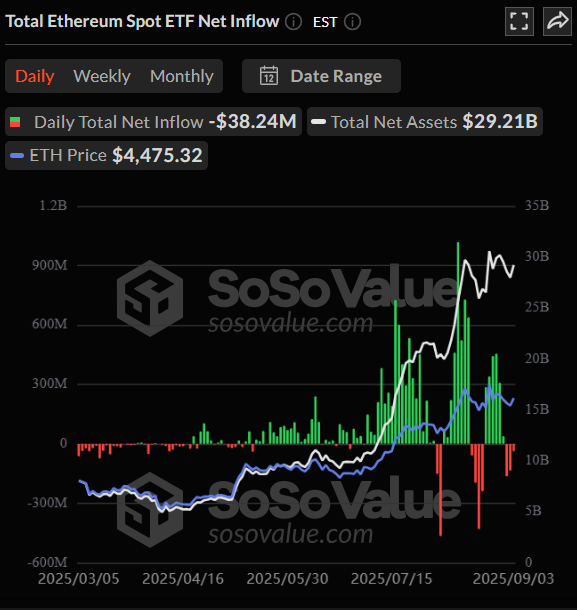

Ethereum exchange-traded funds (ETFs) are facing a wave of investor withdrawals, posting net outflows for three consecutive days. This trend highlights a significant cooling in sentiment around Ether, especially when compared to Bitcoin ETFs, which continue to attract steady and substantial inflows.

Breaking Down the Outflows

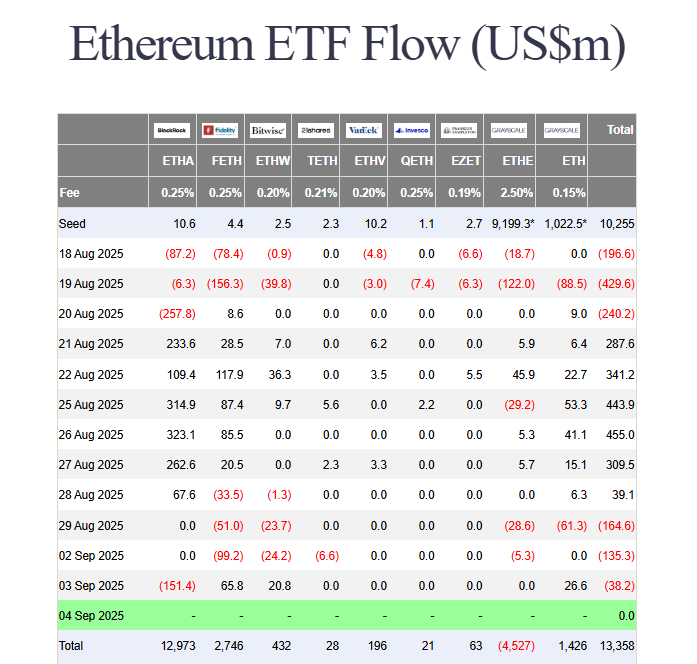

Data from SoSoValue reveals the details of the recent slump:

- September 3 Outflows: $38.2 million

- 3-Day Total Outflows: Approximately $338 million

- Biggest Outflow: BlackRock’s iShares Ethereum Trust (ETHA) led the redemptions with a substantial $151 million outflow.

The outflows were partially offset by inflows into other funds. Fidelity’s FETH attracted $65.8 million, Grayscale’s ETH saw $26.6 million, and Bitwise’s ETHW pulled in $20.8 million.

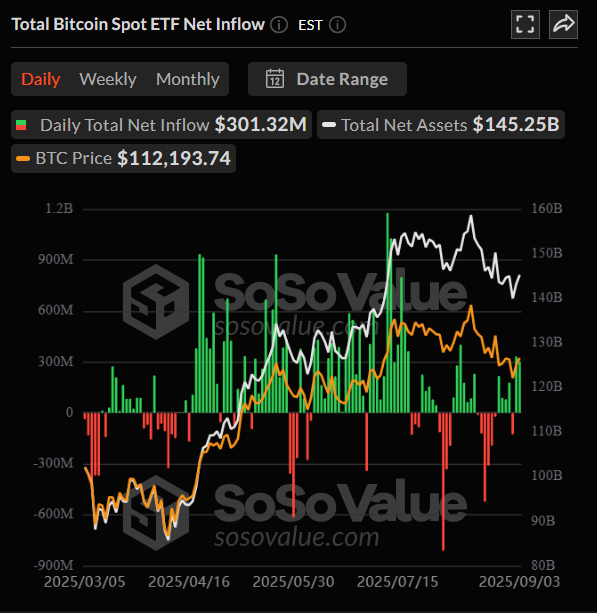

A Stark Contrast to Bitcoin ETFs

The struggle for Ethereum ETFs is even more pronounced when compared to their Bitcoin counterparts. While ETH products were bleeding money, Bitcoin ETFs enjoyed a two-day streak of inflows totaling over $634 million.

This divergence suggests a notable rotation of institutional capital from Ethereum back to Bitcoin, or at least a pause in the enthusiasm that drove ETH’s massive inflows in late August.

What’s Causing the Cool-Off?

The outflows coincide with ETH’s own price struggles, creating a feedback loop. As the price of Ethereum stagnates or dips, it can dampen investor enthusiasm for the related ETF products.

This three-day streak is a sharp reversal from the prior week, when Ethereum ETFs recorded six straight days of inflows, pulling in a massive $1.8 billion. The sudden shift indicates that the recent rally may have been overextended, leading to a natural period of profit-taking and consolidation.

The Bottom Line

While three days of outflows is a concern, it’s important to view it in context. The outflows are modest compared to the recent inflows, and the overall narrative for Ethereum ETFs is still young. This could simply be a short-term correction after a parabolic run.

However, the contrast with Bitcoin’s strong inflows is a key metric to watch. If this trend continues, it could signal a longer-term shift in institutional preference back toward the original cryptocurrency. For now, it appears Ethereum is taking a breather.