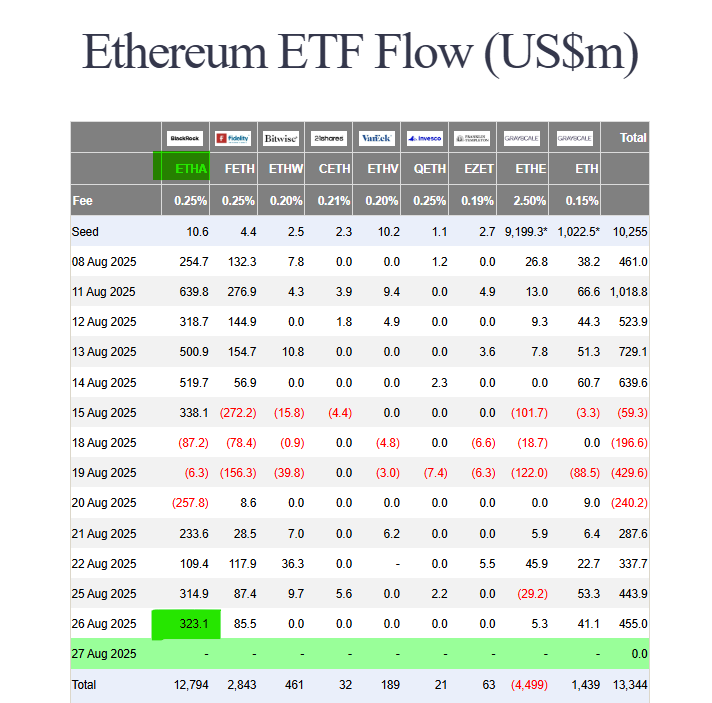

The institutional floodgates for Ethereum are wide open. U.S.-listed Ethereum ETFs recorded a staggering $455 million in net inflows on August 26, marking their fourth consecutive day of gains. This massive wave of capital, led by BlackRock, has propelled total inflows past the $13 billion milestone since launch and is helping fuel a strong price recovery for ETH.

BlackRock’s Dominance Continues

The world’s largest asset manager is single-handedly driving the Ethereum ETF narrative. BlackRock’s iShares Ethereum Trust (ETHA) was the undisputed leader, contributing a massive $323 million to the day’s total.

The numbers are staggering:

- Assets Under Management (AUM): $16.5 Billion

- ETH Holdings: 3.775 Million ETH

- Recent Purchase: 71,037 ETH ($323M) on Aug. 26

- ETHA Share Price: Up 4% for the day and over 100% in the last six months.

Notably, BlackRock has accumulated over 2 million ETH in just the last two months, demonstrating an incredibly aggressive accumulation strategy.

Ethereum ETFs Are Outpacing Bitcoin

A fascinating trend is emerging: Ethereum ETFs are now consistently outpacing their Bitcoin counterparts. While ETH funds saw $455M inflows, Bitcoin ETFs gathered a more modest $88.2 million.

This “significant rotational shift” from Bitcoin to Ethereum suggests that institutions are increasingly viewing ETH as a compelling standalone asset, not just a complement to BTC. The narrative around Ethereum’s scalability upgrades and its role in decentralized finance (DeFi) appears to be resonating with large investors.

ETH Price Bounces Back on Strong Fundamentals

The huge inflows are providing fundamental support for the Ethereum price. ETH has bounced back strongly from a pullback to $4,300 last week, gaining 4.5% in a day to trade above $4,600.

Analysts are watching key levels:

- Resistance: The 2021 all-time high near $4,900

- Support: The local zone between $4,000 and $4,100

The momentum is further supported by continued buying from corporate treasuries. Bitmine Technologies (BMNR), for instance, purchased nearly 200,000 ETH last week alone.

The Bottom Line

The message from Wall Street is clear: institutional demand for Ethereum is not just real; it’s accelerating. With four straight days of massive inflows and BlackRock leading a historic accumulation, the fundamental case for ETH is stronger than ever. For investors, this represents a powerful vote of confidence that could propel Ethereum to new all-time highs.