Ethereum Price Breakdown: $3,000 Support Caves Under Record ETF Exodus

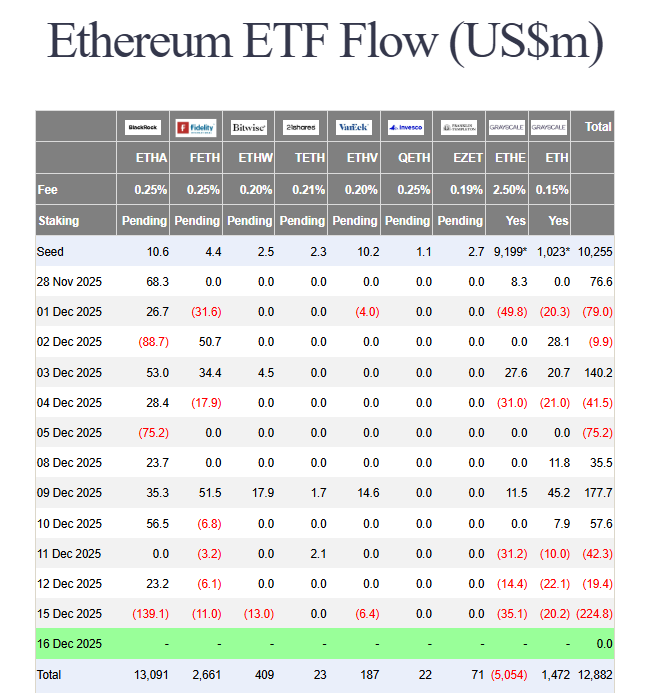

A critical technical failure is unfolding. A severe Ethereum price breakdown has demolished the crucial $3,000 psychological support level, triggered by a perfect storm of massive institutional selling and a brutal liquidation cascade. Spot Ethereum ETFs just recorded their largest single-day outflow in weeks—a staggering $224.7 million—as BlackRock and Grayscale led a third consecutive day of exits, undermining the very foundation of recent institutional demand.

The Catalyst: Institutional Doors Swing Shut

The data is alarming. Over the last three days, spot Ethereum ETFs have bled nearly $286.5 million. Monday’s outflow was the heaviest since late November, with zero funds seeing inflows. This isn’t retail fear; this is institutional capital hitting the exit, directly contradicting the “institutional adoption” bull thesis that has propped up sentiment. When the biggest names in finance (BlackRock’s IBIT, Grayscale’s ETHE) are leading the sell-off, the market listens—and panics.

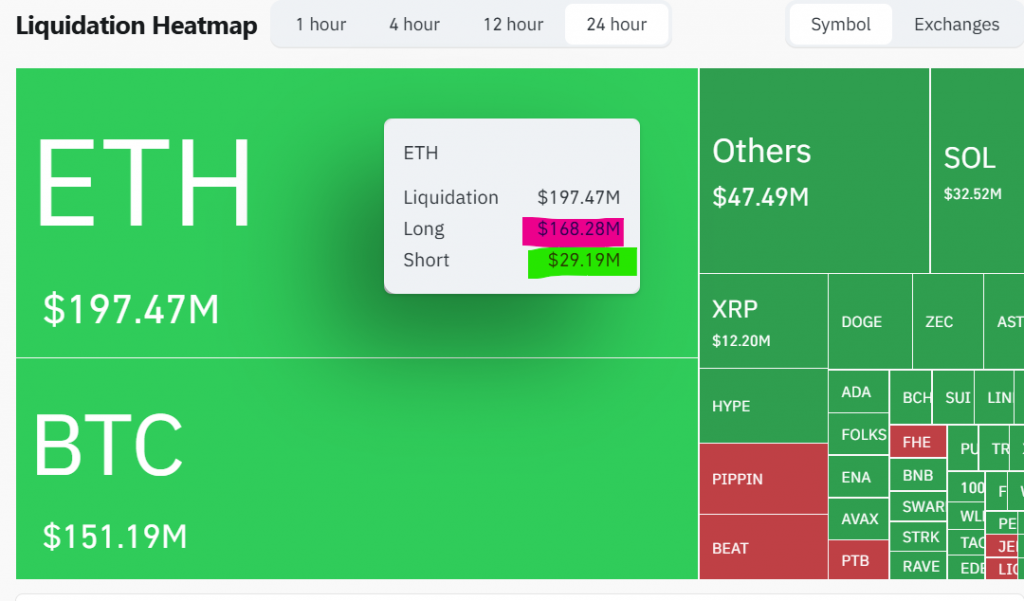

The Domino Effect: A $207 Million Liquidation Cascade

The ETF-driven sell-off triggered a violent chain reaction in derivatives markets. As price sliced through $3,000, it triggered a liquidation cascade, forcing over $168 million in Ethereum long positions to be automatically closed. This forced selling created a negative feedback loop, accelerating the drop to a low near $2,895. Nearly $545 million was liquidated across crypto, a clear sign of excessive leverage being purged from the system in a painful, but necessary, reset.

Technical Outlook: Bearish Patterns Warn of More Pain

The charts now paint an ominous picture. The daily timeframe confirms a large bearish flag pattern, a classic continuation structure that suggests the downtrend is not over. Furthermore, a death cross (50-day MA below 200-day MA) is in effect. These signals point to a high probability of further downside, with the next major target at the November low of $2,620. For any hope of a reversal, bulls must reclaim $3,170 resistance.

Macro Context: A Risk-Off Climate Prevails

This breakdown occurs in a hostile macro environment. With the Fed signaling only one potential rate cut for 2026 and key U.S. jobs data looming, investors are in full risk-off mode. Cryptocurrencies thrive on liquidity and loose policy; the current “higher-for-longer” uncertainty is a direct headwind.

My Thoughts

This is a significant shift in market structure. The loss of $3,000 isn’t just a number; it’s a failure of a key defense that held through multiple tests. The ETF outflows are the most concerning element, as they question the durability of institutional demand. While this flush cleans out dangerous leverage, the path back will be difficult. Ethereum needs to quickly reclaim $3,170 to prevent a deeper slide toward $2,600. Until then, the trend is bearish.