In a surprising turn of events, the Ethereum price drop 5% today, decisively losing the critical $4,000 support level. This bearish move happened despite what appeared to be a highly favorable macroeconomic backdrop. The Federal Reserve not only delivered a expected 25 bps rate cut but also announced a plan to end its quantitative tightening (QT) program. This classic “sell-the-news” reaction has left many traders questioning the short-term trajectory.

Macro Euphoria Fails to Lift ETH

The market’s reaction is a stark reminder that price movement is about expectations versus reality. While the Fed’s decision to end QT is structurally bullish for liquidity, it was likely already priced in. Consequently, traders used the event as an opportunity to take profits. Crypto analyst Ted Pillows highlighted the irony, noting that ETH fell despite these major developments. He suggests two paths forward: this is either a classic bear trap shaking out weak hands, or a signal that the market is headed significantly lower.

Spot ETF Flows Flip Negative

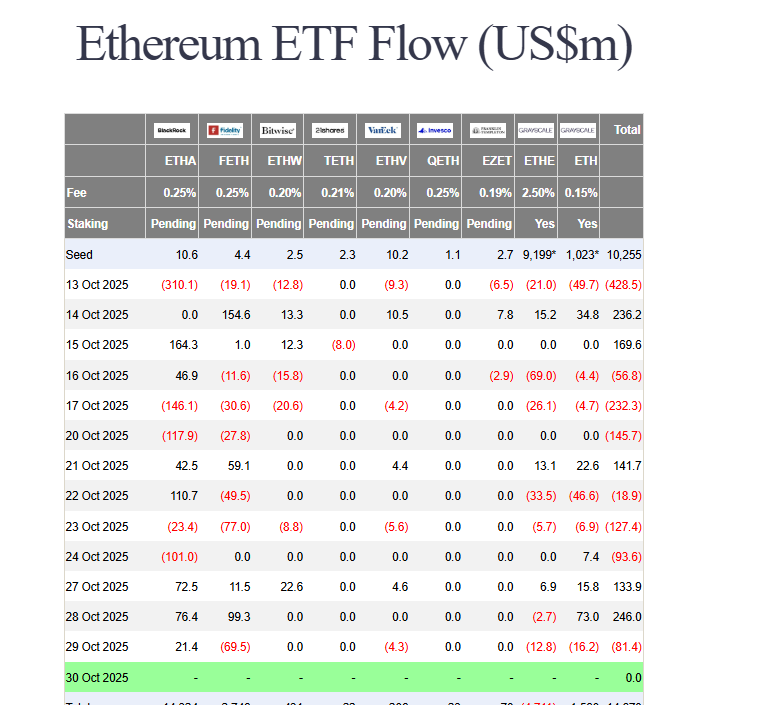

Adding fuel to the bearish fire, spot Ethereum ETF flows have reversed course. After two days of strong inflows, the funds saw net outflows of $84 million on October 29th. Fidelity’s FETH led the retreat with $69.5 million in outflows. This indicates that some institutional players are also taking a cautious stance in the short term. However, it’s not all doom and gloom; BlackRock’s iShares product still saw $21.4 million in inflows, showing that demand hasn’t completely vanished.

Key Levels to Watch Now

The technical picture has clearly weakened. The loss of the $4,000 level is a significant blow to bullish momentum. Analyst IncomeSharks warns that ETH must reclaim this level to keep the bull market intact. If it fails to do so, the next major support doesn’t appear until much lower, with some charts pointing toward the $2,200 area. Meanwhile, futures open interest dropped 2.7%, indicating a unwind of leveraged positions that contributed to the Ethereum price drop.

My Thoughts

This feels like a healthy, if painful, flush-out. The market needed to clear overleveraged longs and reset. The fundamental backdrop of ending QT is still positive, and this dip could be a prime accumulation zone for patient investors. However, if $3,800 breaks, a deeper correction to $3,500 is likely before the next leg up.