Ethereum is flexing its muscles at a critical level. After a brief 5% pullback, ETH is firmly consolidating above the $4,000 support zone. This isn’t just a technical pause; it’s a coiled spring. Meanwhile, institutional money is flooding back into spot Ethereum ETFs, creating a powerful fundamental backdrop. Top analysts are now united in a bullish Ethereum price prediction, with targets ranging from $5,000 in the near term to a staggering $8,000+ later this cycle.

The FOMC Catalyst: Fuel for the Rally

All eyes are on the Federal Reserve. The current FOMC meeting is expected to deliver another 25-basis-point rate cut, a move that typically ignites risk-on assets like cryptocurrencies. Popular analyst Michael van de Poppe notes that Ethereum price is building momentum within a tight range. He believes the next major leg up is directly tied to macro conditions. Consequently, a dovish Fed could be the exact trigger that launches ETH toward the coveted $5,000 mark, finally breaking its all-time high.

ETF Inflows Confirm Institutional Conviction

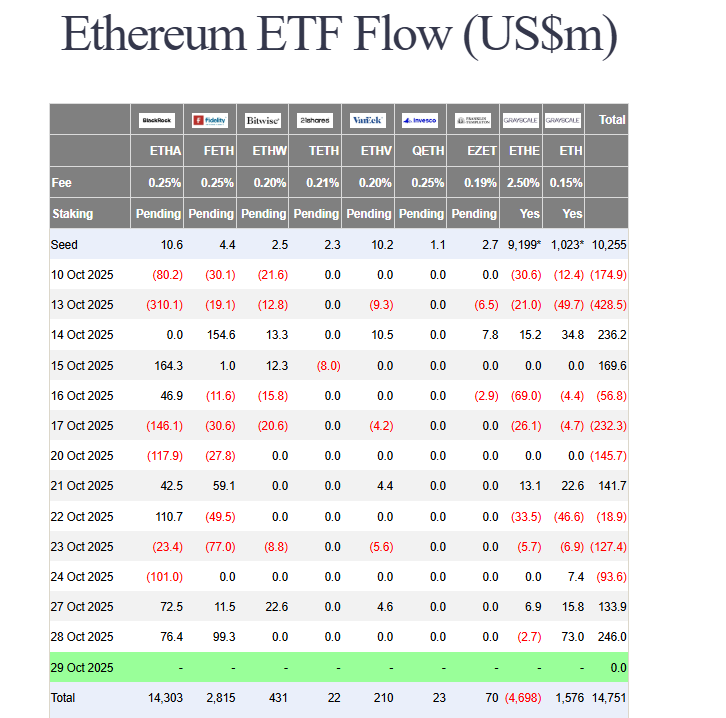

The institutional story is getting stronger by the day. After a period of stagnation, spot Ethereum ETFs have roared back to life. On Tuesday alone, these funds saw a massive $246 million inflow. Fidelity’s fund led the charge with a huge buy-in, followed by strong numbers from BlackRock and Grayscale. This isn’t just random noise; it’s a clear signal that major financial players are using recent dips to accumulate. This sustained demand provides a solid foundation for higher prices.

Ethereum Price Technical Setup and the Road Ahead

Technically, the picture remains intensely bullish. The successful reclaim of $4,000 earlier this week was a critical victory for the bulls. As long as ETH holds support between $3,800 and $4,000, the path of least resistance is upward. Furthermore, the upcoming Fusaka upgrade in December, which focuses on scalability and security, adds a fundamental tailwind. The combination of a macro catalyst, institutional inflows, and strong tech developments creates a perfect bullish storm.

My Thoughts

The pieces are aligning for a historic Ethereum breakout. The ETF inflows prove the institutional thesis is alive and well, and a friendly Fed could be the final piece of the puzzle. The momentum is building, and a push past $5,000 could open the floodgates for a parabolic move.