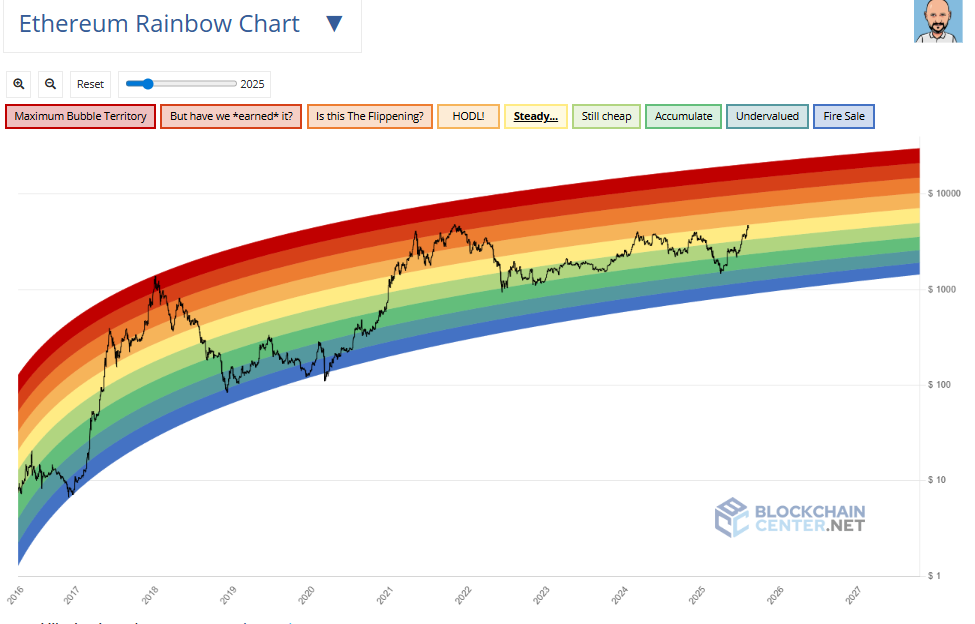

Ethereum has dipped below $4,500 after its recent rally, but the Ethereum Rainbow Chart suggests significantly higher prices could still be in play. This unique valuation tool helps investors spot long-term opportunities beyond short-term volatility.

Understanding the Rainbow Bands

The chart divides ETH’s price into nine colorful valuation zones:

🟥 Fire Sale: $899-$1,217 (Strong Buy)

🟧 Undervalued: $1,217-$1,680

🟨 Accumulate: $1,680-$2,359

🟩 Still Cheap: $2,359-$3,355

🟦 Steady (Fair Value): $3,355-$4,832 ← Current zone

🟪 HODL!: $4,832-$7,015

🟫 Is this The Flippening?: $7,015-$10,200

⬛ But have we earned it?: $10,200-$14,581

💥 Maximum Bubble Territory: $14,581-$20,778

At $4,442, ETH sits comfortably in the “Steady” range – neither overbought nor oversold by historical standards.

Technical Indicators Remain Bullish

• 50-day SMA ($3,413) and 200-day SMA ($2,596) show strong uptrend

• RSI at 66.86 – Healthy buying pressure (not yet overbought)

• Weekly gain of 4.5% despite recent dip

What’s Next for Ethereum?

The chart suggests two potential paths:

- Conservative Scenario: Holds $3,355-$4,832 through August

- Bullish Breakout: Could test $7,015 “HODL!” zone if momentum returns

While short-term pullbacks are normal, the overall technical picture confirms Ethereum’s bull market remains intact.