Ethereum Price Volatility Primed to Explode Amid Conflicting Signals

Get ready for fireworks. Major Ethereum price volatility is on the horizon, with a powerful bullish divergence pattern flashing for the first time in a month—a signal that historically precedes 9-16% swings. This technical setup clashes with the current post-Fed sell-off, creating a tension-filled market ripe for a explosive directional move. Buckle up.

The Chart Screams “Reversal”: Bullish Divergence Returns

Despite the 3.5% dip below $3,200, a critically important technical signal has emerged. Analysts are pointing to a strong “Bullish Divergence” on Ethereum’s chart, scoring a historically meaningful 7.61 on the strength meter. The last three times this signal appeared, ETH ripped or dumped 9-16%. This indicator doesn’t guarantee direction, but it screams that a significant volatility expansion is imminent. The pattern suggests the current weakness may be a bear trap, setting the stage for a sharp reversal.

Whale Conviction Defies the Fear: A $392 Million Leveraged Bet

While retail panics, a mega-whale is doubling down with staggering conviction. The entity known as “1011short” has increased its leveraged long position to a jaw-dropping 120,094 ETH ($392.5 million). This isn’t a timid bet; it’s a high-conviction, high-leverage gamble with a liquidation price far below at $2,234. This move signals that some of the smartest, deepest-pocketed players see this dip as a prime buying opportunity, not a reason to exit.

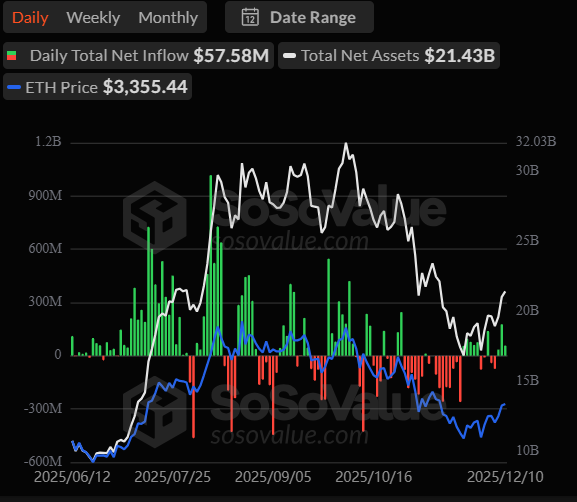

Institutional Engine Keeps Running: Relentless ETF Inflows & Buying

The fundamental demand story remains rock-solid. Spot Ethereum ETFs have seen over $250 million in net inflows this week alone, proving institutional capital is steadily flowing in regardless of daily price action. Furthermore, Tom Lee’s BitMine Technologies (BMNR) continues its aggressive accumulation, buying another 33,504 ETH ($112M) today. They are on a warpath to hold 5% of all ETH. This isn’t speculation; it’s strategic, long-term treasury allocation.

My Thoughts

This is the beautiful chaos of a market at an inflection point. The technicals hint at a major low, a whale is betting the farm on it, and institutions are blindly buying the dip via ETFs. The post-Fed sell-off looks like a classic liquidation of weak leverage, not a change in trend. When this many aligned signals (divergence, whale buying, ETF inflows) hit during a fear-driven dip, it’s usually time to pay attention. The stage is set for a violent move upward if ETH can reclaim $3,300.