September has been a tough month for Ethereum. The price has fallen 13% from its all-time high of $4,953, and spot ETFs have seen significant outflows. However, beneath the surface of negative sentiment, a powerful story of long-term conviction is unfolding, as savvy investors are using the dip to accumulate massive amounts of ETH.

The Bearish Headlines: Price Drop and ETF Outflows

The obvious narrative is bearish. ETH has been on a consistent decline since hitting its peak on August 24.

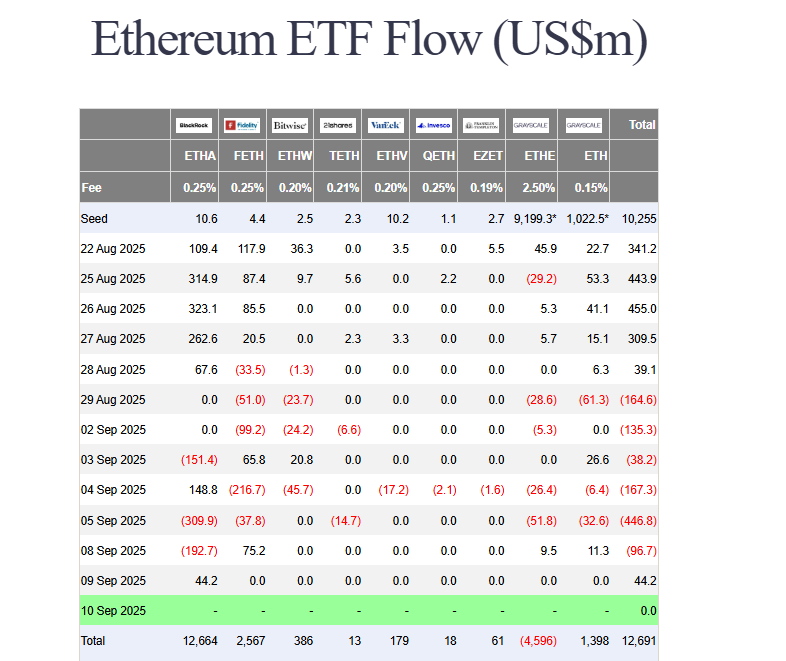

Compounding the price pressure, U.S. spot Ethereum ETFs recorded six straight days of net outflows from August 29 to September 8, totaling a substantial $1.04 billion in withdrawn capital. This combination of falling prices and fleeing institutional money has created a cloud of negative sentiment.

The Bullish Reality: Major Exchange Exodus

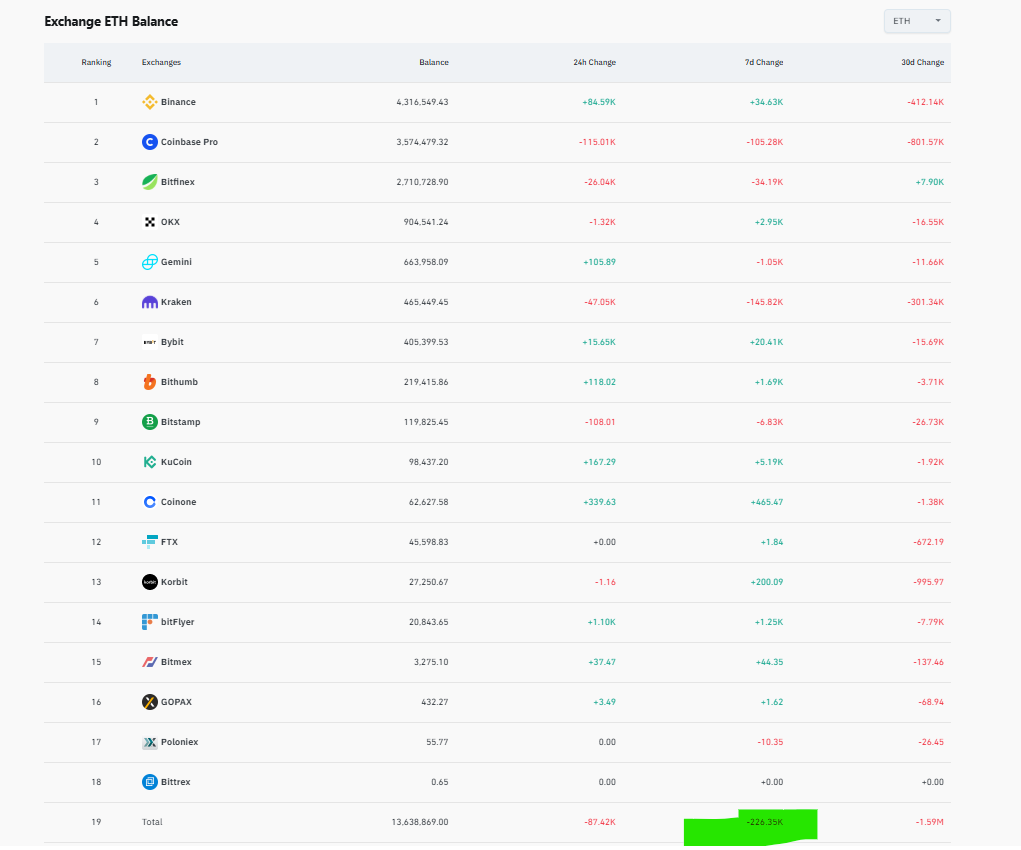

But the real story is found in on-chain data, which tells a completely different tale. Despite the fear, investors are aggressively pulling their ETH off exchanges.

- Total Outflows: 226,400 ETH

- Top Exchanges: Kraken led with outflows of 146,000 ETH, followed by Coinbase (105,170 ETH) and Bitfinex (34,330 ETH).

This massive movement of coins off trading platforms is a classic bullish signal. It indicates that investors are moving their ETH into long-term cold storage, reducing the immediate selling supply and signaling their belief in higher future prices.

A Glimmer of Hope in ETFs

The ETF flow story also showed a sign of life. On September 9, the bleeding temporarily stopped as the funds recorded a net inflow of $44.2 million, led solely by BlackRock’s iShares Ethereum Trust (ETHA). This suggests that even within the institutional world, some buyers are stepping in.

The Catalyst: Fed Rate Cut FOMO

So, why the sudden accumulation? Much of it can be attributed to FOMO (Fear Of Missing Out) surrounding the widely anticipated Federal Reserve interest rate cut.

Historically, easy monetary policy acts as rocket fuel for risk-on assets like cryptocurrencies. Investors are likely positioning themselves ahead of this potential macro catalyst, expecting it to ignite the next major rally for Ethereum and the broader crypto market.

The Bottom Line

The market is presenting a tale of two Ethereums. The short-term price action and ETF flows look weak, but the underlying on-chain data reveals strong hands are accumulating. For a true bullish reversal to take hold, ETH needs to reclaim the key $4,500 psychological level. Until then, the battle between short-term traders and long-term believers continues.