Bullish Lock-Up: Ethereum Staking Exit Queue Drops to Zero

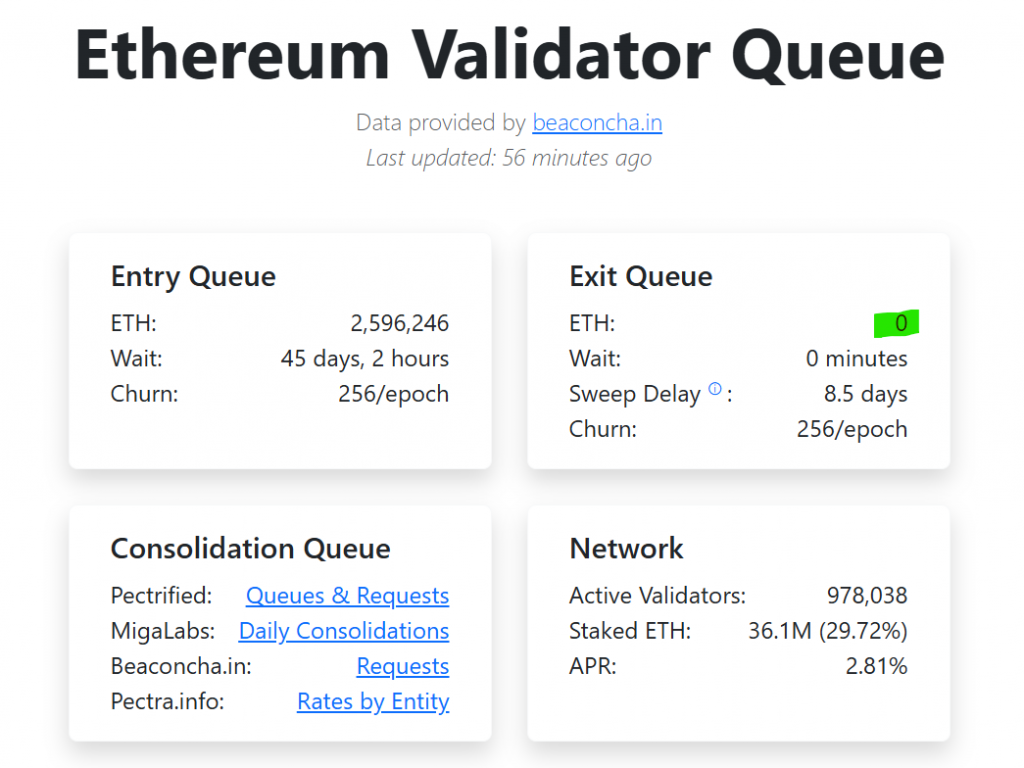

Get ready for a major supply shock. In a stunning display of long-term conviction, the Ethereum staking exit queue—the line of validators waiting to withdraw their ETH—has officially dropped to zero. Simultaneously, the entry queue has ballooned to 2.6 million ETH, creating a massive 45-day waitlist. This dramatic flip signals that stakers are locking up their Ether en masse, drastically reducing sell-side pressure and setting the stage for a powerful supply squeeze.

This isn’t just a minor metric change; it’s a fundamental shift in market structure. The exit queue peaked at 2.67 million ETH last September. Its complete evaporation means no stakers are currently signaling a desire to sell their locked ETH. Meanwhile, the enormous entry backlog shows capital is flooding in, desperate to earn the network’s ~2.8% yield. This creates a one-way valve: ETH is flowing in and staying put.

Institutional Demand Fuels the Ethereum Staking Rush

Who’s driving this? Institutions are a primary force. Giants like BitMine Immersion Technologies, chaired by Tom Lee, have staked over 1.25 million ETH alone. This institutional hunger for real yield transforms ETH from a speculative asset into a productive, yield-bearing one. The data is clear: nearly 46.5% of all ETH in existence is now in the PoS deposit contract, representing over $256 billion in value being taken off the speculative market.

Analysts see this as an incredibly bullish setup. As Onchain Foundation’s Leon Waitmann stated, once this entry queue converts to active validators, the staking rate will push toward new all-time highs. This relentless accumulation, especially while ETH trades 33% below its ATH, suggests smart money is building a position for the next cycle, not trading short-term volatility.

My Thoughts

This is one of the most bullish on-chain setups I’ve seen. The staking dynamics are creating a voluntary, algorithmic supply freeze. With no one exiting and a huge line to get in, available liquid supply is shrinking fast. When you combine this with upcoming ETF developments and the growing institutional narrative, the fundamentals for ETH have never been stronger. Price might be range-bound now, but this is the kind of silent accumulation that precedes explosive moves. The market is structurally tightening.