Brace yourselves, crypto fam! The institutional gates are swinging wide open for a hidden gem. Teucrium Trading LLC has just dropped a bombshell by filing for a Flare ETF with the SEC.

Flare ETF Filing Sparks Institutional Excitement

This isn’t just another product; it’s a massive validation for the entire Flare Network ecosystem. Hugo Phillion, Flare’s Co-Founder, confirmed the news on X, instantly sending shockwaves through the crypto community. Remember, Teucrium pioneered the first leveraged XRP ETF in the U.S., so their move here signals serious conviction. Consequently, this ETF could funnel institutional billions into Flare’s burgeoning DeFi landscape.

Why This Flare ETF is a Game Changer

Timing is everything, and this filing coincides with Flare’s explosive growth. The network’s DeFi activity is going parabolic, with FXRP minting soaring past $120 million since its September launch. How does it work? Through Flare’s innovative FAssets system, users lock XRP to mint equivalent ERC-20 tokens. This unlocks decentralized lending, liquidity pools, and yield farming opportunities. As a result, Flare has rapidly become the largest EVM-compatible DeFi ecosystem built around XRP. Total Value Locked (TVL) skyrocketed 38% in just over a month. Demand is so fierce that initial minting caps were swallowed within hours—a clear sign of rampant adoption.

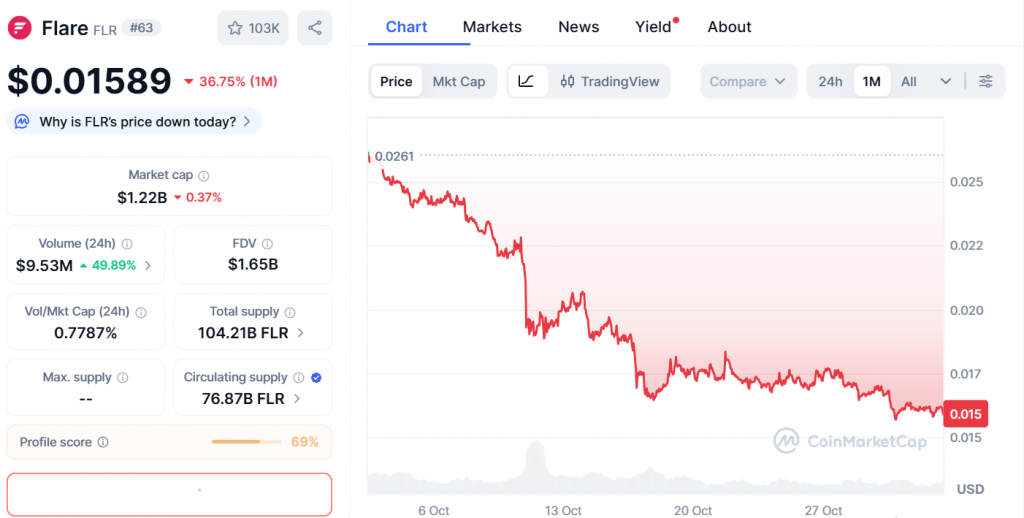

FLR Token’s Paradox: Adoption vs. Price

Here’s where it gets intriguing. Despite the network’s blistering growth, the FLR token has lagged, dipping 38% to roughly $0.016. Why the disconnect? On-chain data reveals that users are chasing yields in stablecoins or XRP derivatives instead of accumulating FLR. Even SparkDEX’s relaunch of FXRP perpetuals and $120 million in inflows haven’t buoyed the native token yet. However, this divergence often signals a prime accumulation zone. When fundamentals strengthen while prices stagnate, savvy traders see an alpha opportunity.

My Thoughts

As a crypto KOL, I believe this ETF filing is a landmark event. Flare’s unique infrastructure bridges XRP’s massive liquidity with DeFi’s yield-generating potential. Institutional interest via an ETF could trigger a re-rating for FLR, similar to how SOL ETFs ignited Solana’s rally. While the token’s short-term performance is underwhelming, the underlying adoption is undeniable. This dip might be a golden entry point before the ETF approval catalyzes a parabolic move. Keep your eyes peeled!