A Major Step Forward: Grayscale Updates Filing for Spot Avalanche ETF

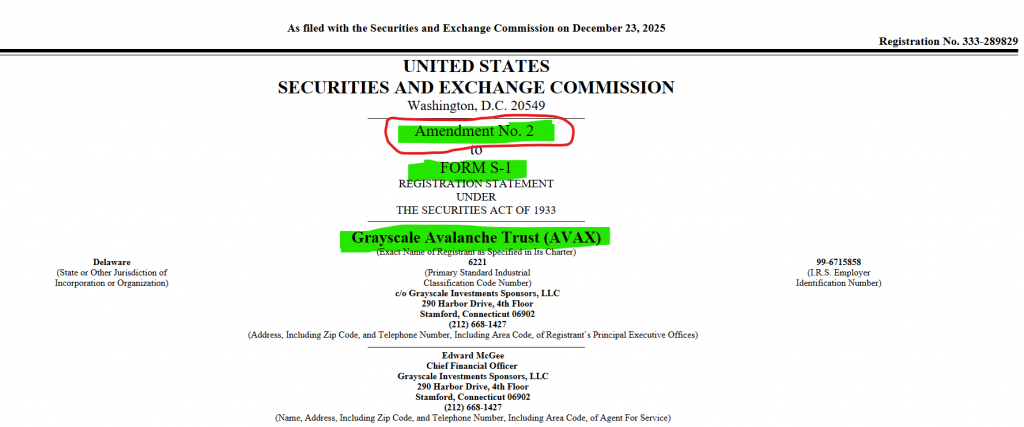

SECThe march toward a major new altcoin ETF is accelerating. Crypto asset manager Grayscale has filed a second amended S-1 form with the SEC for its spot Avalanche ETF, moving the proposed fund one step closer to a Nasdaq listing under the ticker “GAVX.” This regulatory progress is a bullish catalyst for AVAX, which is already up over 9% this week on anticipation. The update brings critical details like in-kind creation and tax disclosures into focus, responding directly to SEC feedback.

Grayscale Avalanche ETF: What the Updated Filing Reveals

While the filing doesn’t disclose management or staking fees, it solidifies the fund’s operational framework. Key updates include confirming in-kind creation and redemption—a crucial, crypto-native mechanism that allows authorized participants to exchange AVAX tokens for ETF shares directly, which is generally viewed as more efficient than cash-only models.

The filing also confirms Grayscale Investments Sponsors LLC as the sole sponsor. This follows last week’s news that competitor VanEck set its proposed Avalanche ETF fee at 0.30% and named Coinbase as its staking provider, setting the stage for a competitive fee and staking yield landscape once approvals are granted.

AVAX Price and Market Reaction

AVAX price reacted with a 2.5% dip in the last 24 hours, trading around $11.99 after a strong weekly rally. Trading volume has declined nearly 18%, indicating cautious consolidation. Meanwhile, derivatives data shows a slight pullback, with total futures open interest down 2% to $489 million.

This activity comes after a reported meeting between the SEC’s Crypto Task Force and industry representatives, including Ava Labs. The timing suggests regulatory dialogue is actively shaping these filings.

My Take

This is a textbook “buy the rumor, anticipate the news” setup. Each amended filing reduces regulatory uncertainty and builds the runway for launch. An Avalanche ETF would be a monumental legitimacy boost for the ecosystem, funneling institutional capital directly into AVAX. While short-term price action is choppy, the strategic implication is clear: AVAX is in the institutional onboarding pipeline. Accumulating on dips ahead of a potential approval is a high-conviction move.