Institutional allocation just delivered a fascinating plot twist. Harvard University has dramatically pivoted its crypto strategy, selling $21 million worth of Bitcoin ETF shares while simultaneously building an $86.8 million position in BlackRock’s Ethereum ETF (ETHA). The move comes as Ethereum price tumbles back below $2,000, raising urgent questions about the Ethereum Bet impact on the price outlook in this volatile macro environment.

Harvard’s Crypto Pivot: From BTC to ETH

Harvard Management Co (HMC) reduced its BlackRock Bitcoin ETF (IBIT) holdings by 21%, selling 1.48 million shares in Q4 2025. Concurrently, it established a substantial $86.8 million ETHA position, bringing its total crypto portfolio to $352.6 million. This isn’t a retreat from crypto—it’s a rotation.

This signals a broader institutional trend: Ethereum is increasingly viewed as a distinct asset class with unique upside, not just a beta play on Bitcoin. While BTC remains the macro hedge, ETH offers exposure to the expanding ecosystem of DeFi, staking, and real-world asset tokenization.

Ethereum ETF Flows Tell a Conflicting Story

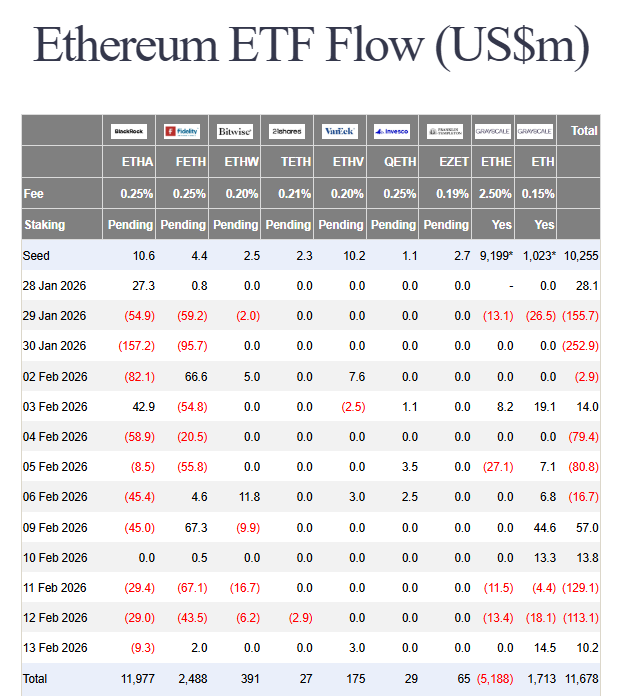

Despite Harvard’s vote of confidence, the broader ETF market remains skittish. Ethereum spot ETFs recorded $161 million in net outflows last week, with BlackRock’s ETHA bleeding $113 million—the largest single outflow. Fidelity’s FETH lost another $40.75 million.

The sole bright spot? Grayscale’s Ethereum Mini Trust ($ETH) pulled in $49.9 million, demonstrating that investor preference is fragmenting across products.

Ethereum Price Outlook: The $1,900 Make-or-Break Level

At press time, ETH trades at $1,973, struggling to reclaim momentum after cracking below $2,000. The MACD is firmly bearish: histogram bars are deep red, and the MACD line sits below the signal line, confirming ongoing downward pressure.

If $1,900 support fails, the next logical target is the $1,800 swing low—a level that has historically attracted strong buying interest. Conversely, a reclaim of $2,100 would signal a potential trend reversal, opening a path toward $2,200 and beyond.

My Thoughts

This is a high-signal, low-noise development. Harvard’s move tells us that endowment-level capital is treating Ethereum as a strategic allocation, not a speculative trade. The timing—buying during ETF outflows and price weakness—is classic institutional behavior: accumulate when retail capitulates.

The Ethereum Bet has impacted the price outlook hinges on whether this institutional conviction translates into sustained buying pressure. Right now, macro uncertainty is overriding fundamentals. But once the Fed fog clears, ETH’s structural demand (staking, L2 activity, RWA growth) will reassert itself.

I view sub-$2,000 ETH as a generational accumulation zone. Harvard agrees. The question is whether you have the patience to follow their lead.