The trend of public companies holding Solana continues to accelerate. Japanese gaming firm Mobcast Holdings has announced a new Solana treasury initiative, planning to invest approximately $10 million into SOL as a strategic reserve asset.

Details of the New Solana Treasury

Mobcast, listed on the Tokyo Growth Market, is establishing a dedicated business unit for its new Sol treasury. The company plans to raise 1.4 billion yen (about $10 million) through equity and corporate bonds to fund the SOL acquisitions.

Consequently, this move aims to strengthen its financial foundation and enhance shareholder value. Therefore, Mobcast is joining a growing institutional wave embracing Solana as a corporate asset.

The Expanding Corporate Solana Treasury Trend

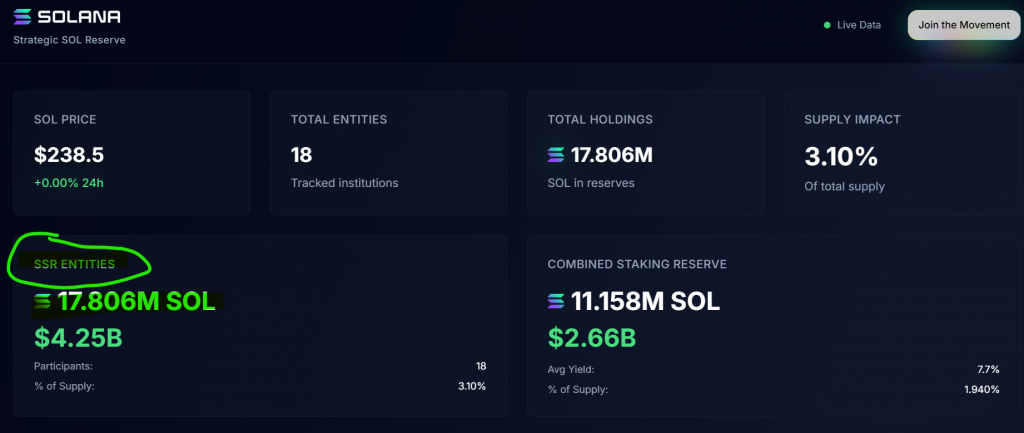

Mobcast is not alone. Currently, nearly 20 public companies collectively hold 17.80 million SOL, representing over 3% of the total supply.

For instance, major holders include Forward Industries and Sharps Technology, which recently announced a $100 million stock buyback to further bolster its own Solana treasury. This growing institutional adoption underscores Solana’s rising appeal for corporate balance sheets.

Broader Market Impact

This corporate Solana treasury trend coincides with strong market performance. Simultaneously, the Solana Staking ETF (SSK) has reached a record $382 million in assets under management.

Furthermore, SOL’s price has reacted positively, trading at $230 and posting an 18% weekly gain. Ultimately, the convergence of corporate buying and ETF growth creates a powerful bullish narrative for Solana.