LINK Price Rally Explodes 20% on Historic ETF Catalyst

A powerful LINK price rally is dominating the altcoin scene, with Chainlink surging 20% to smash past $14. This explosive move isn’t random; it’s fueled by a landmark institutional milestone and a decisive technical breakout. With trading volume soaring 84% and a major wall of resistance breaking, LINK is signaling a strong bullish phase ahead.

Technical Breakout Points to $20 Target

After a tough November, LINK has staged a remarkable recovery. The price has not only held a critical support zone but has now broken out of a prolonged consolidation pattern. This technical strength is confirmed by a massive 24% surge in futures open interest, exceeding $630 million, which shows heavy leveraged betting on further upside. Prominent analysts note this structure opens a clear path for LINK to target the $20 level in the near term, representing a significant rally from current prices.

The Game-Changer: Grayscale’s Chainlink ETF Debuts

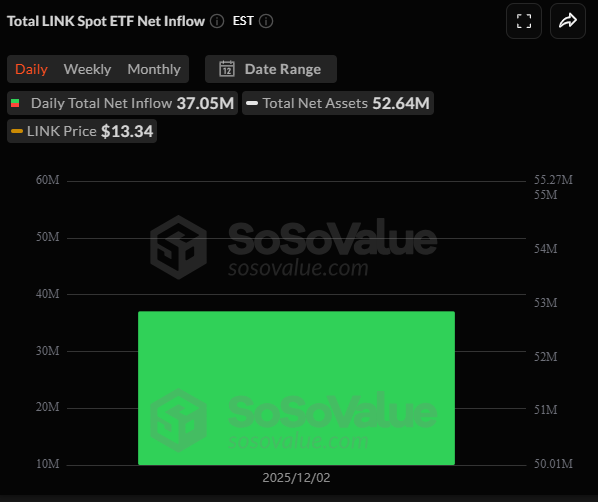

The core catalyst for this surge is unequivocal: the first-ever U.S. spot Chainlink ETF began trading. Grayscale converted its Chainlink Trust into the publicly traded GLNK ETF on the NYSE. The debut was a resounding success, with 1.17 million shares traded on day one—volume that dwarfed its previous daily average as a private trust, The total Net Inflow was $37.05 Million on the first day alone. This event fundamentally transforms institutional access, allowing a massive new investor base to gain LINK exposure through traditional brokerage accounts.

Market Impact and What Comes Next

This LINK price rally reflects a market repricing Chainlink’s value. Despite trading at a 50% discount from its yearly highs, the network’s fundamentals have grown stronger throughout 2025. The ETF launch acts as a forcing function, catching LINK up to this improved reality. The convergence of a technical breakout and a permanent, structural increase in demand creates a compelling bullish case.

My Thoughts

Grayscale’s ETF launch is a watershed moment for Chainlink. It’s not just another listing; it’s a legitimization that places LINK alongside Bitcoin and Ethereum as a crypto asset worthy of its own dedicated ETF. The impressive first-day volume, capturing nearly half of Coinbase’s typical daily activity, proves the pent-up demand was real. This fundamentally alters the supply and demand dynamics. With strong technicals now aligned, the path toward $20 looks increasingly probable.