Get ready for a massive leap in institutional adoption. In a landmark move, Ondo Finance & Chainlink have announced a strategic partnership aimed squarely at bringing traditional finance into the on-chain world.

This collaboration will see Chainlink’s industry-leading oracle infrastructure provide secure, transparent price feeds for Ondo’s tokenized stocks and ETFs. Furthermore, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is now the preferred standard for cross-chain asset movement. This is a huge vote of confidence in the infrastructure needed for real-world assets (RWAs).

Why This is a Game Changer for RWAs

Ondo Finance is already a titan in the RWA space, managing a staggering $1.8 billion in assets across ten blockchains. By integrating Chainlink’s oracles, Ondo’s tokenized assets—like US Treasury bonds and equities—gain unparalleled data accuracy and security. This is critical for institutional players who require absolute reliability. Consequently, this partnership breaks down a major barrier to entry, allowing asset managers and financial intermediaries to confidently tap into on-chain capital markets with the transparency and compliance they demand.

Expanding the Tokenization Empire

This partnership is just one part of Ondo’s aggressive expansion strategy. Just a day before this announcement, Ondo expanded its massive tokenization platform to BNB Chain, one of the largest ecosystems. This follows the launch of Ondo Global Markets, which offers over 100 tokenized equities on Ethereum. The Ondo Finance & Chainlink alliance supercharges this growth, providing the robust backend needed to scale securely across multiple chains and attract even more major players.

ONDO Token Price Action: Looking Beyond the Dip

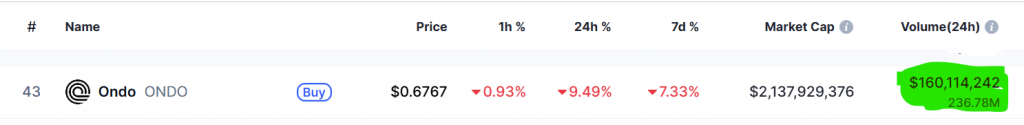

Despite the bullish news, the ONDO token saw a 5% price dip, largely mirroring a broader market slump. However, look deeper and the metrics tell a different story. Trading volume surged 60% to $165 million, indicating massive interest and engagement. This classic “buy the rumor, sell the news” action often creates a prime accumulation opportunity. Once market conditions stabilize, the fundamental value created by this partnership is likely to be reflected in the price.

My Thoughts

This is exactly the kind of foundational partnership that builds the next cycle’s narrative. It’s not about speculative memes; it’s about building the plumbing for trillions of dollars in real-world assets to flow on-chain. While the token price reacted negatively to macro conditions, the long-term implications for both ONDO and the entire RWA sector are profoundly bullish.