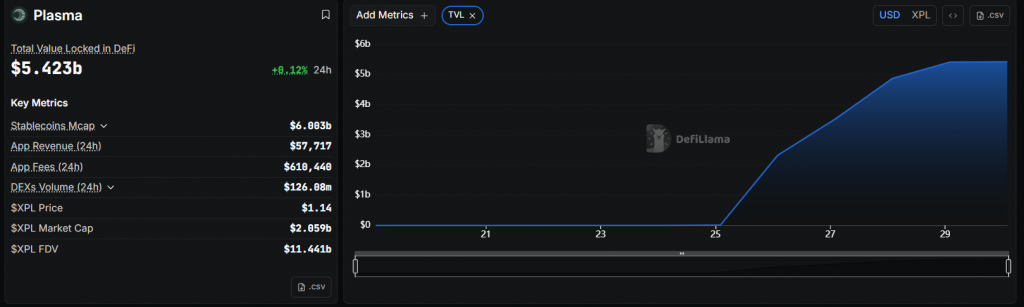

The Plasma price has experienced a sharp 13% correction, retreating from its recent peak to trade at $1.14. However, this surface-level sell-off hides a much more bullish story developing beneath. While the price dropped, the network’s Total Value Locked (TVL) more than doubled to $5.45 billion, creating a fascinating divergence for investors.

Strong Fundamentals Underpin Plasma Price Prediction

Despite the price decline, Plasma’s fundamental health is stronger than ever. The explosive growth in TVL from $2.32 billion to $5.45 billion in a matter of days is a powerful signal of robust network adoption and capital inflow.

This growth is fueled by Plasma’s successful mainnet launch, which seeded $2 billion across over 100 DeFi protocols like Aave and Ethena. This strong foundation is a critical factor in any near-term Plasma price prediction, suggesting the current dip may be a temporary correction within a larger bullish trend.

Plasma Price Prediction: Key Technical Levels to Watch

So, where does the token go from here? Our technical Plasma price prediction identifies two crucial scenarios:

- Bullish Scenario: The immediate support to hold is $1.12. If buyers defend this level and push the price above the 20-SMA, a rebound toward $1.25 and even $1.30 is likely.

- Bearish Scenario: A decisive break below $1.12 could trigger a steeper decline toward $1.05, with the psychological $1.00 level acting as a major buyer stronghold.

The RSI near 31.8 suggests the sell-off may be overextended, hinting at a potential bounce. However, the overall momentum remains weak in the short term.

The Bottom Line

The current Plasma price prediction presents a classic case of a conflict between price and fundamentals. While technicals point to short-term weakness, the staggering growth in TVL and ecosystem development provides a solid base for a significant recovery. For savvy investors, this dip could represent a strategic accumulation opportunity.