Solana Blockchain Price Strengthens After CPI Surprise

U.S. inflation data surprised markets to the downside, triggering a relief rally across crypto assets. Headline CPI came in at 2.7% YoY, below the 3% expectation, while Core CPI dropped to 2.6%, its lowest level since March 2021.

Bitcoin reacted immediately, jumping from $86,000 to $88,000, and the broader crypto market quickly erased losses on lower timeframes. Amid this rebound, Solana blockchain stands out as the altcoin best positioned to benefit from the next wave, based on fundamentals, ETF flows, and ecosystem growth.

Solana Blockchain Dominates DEX Activity Across All Timeframes

One of the strongest pillars supporting the Solana Blockchain is its dominance in decentralized exchange activity.

According to on-chain data:

- Solana recorded $3.49 billion in DEX volume over the last 24 hours, more than $1 billion ahead of BNB Chain

- Over the last 30 days, Solana processed $96.14 billion in DEX volume, significantly outperforming Ethereum’s $59.51 billion

This clear lead highlights Solana’s competitive advantage in speed, cost efficiency, and user adoption — all critical metrics during market recoveries.

Solana ETF Inflows Remain Positive Despite Volatility

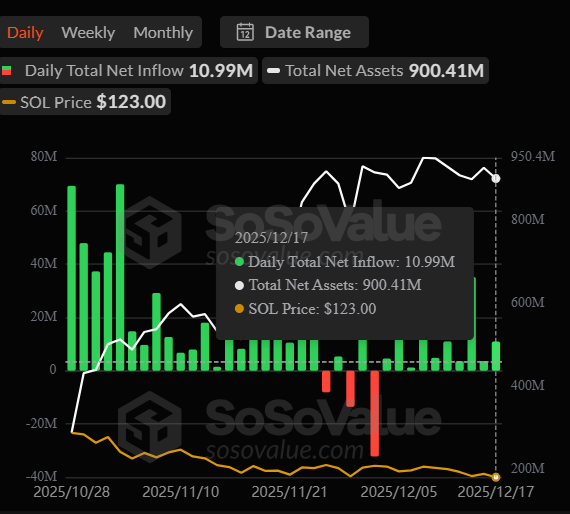

While price action has remained choppy, institutional confidence in Solana Blockchain remains intact. On December 17, the SOL ETF recorded $10.99 million in net inflows, extending its streak of positive flows despite broader market uncertainty.

ETF inflows during periods of volatility often signal accumulation rather than distribution, reinforcing the constructive Solana price outlook for the medium term.

Growing Adoption Strengthens the Solana Ecosystem

Beyond market metrics, Solana continues to expand its real-world integrations:

- Solana has been integrated directly into the Coinbase app, increasing accessibility for retail users

- NEAR is now tradable on Solana, strengthening cross-chain liquidity and ecosystem interoperability

These developments enhance Solana’s long-term network value and help explain why capital continues flowing into SOL-related products.

Solana Price Reaction After CPI Data

Following the CPI release, $SOL surged from $123 to $129, reflecting renewed risk appetite. However, the move cooled quickly, with SOL retracing back to the $123 level.

While short-term volatility persists, the combination of DEX leadership, ETF inflows, and ecosystem growth suggests Solana remains well-positioned if macro conditions continue to improve.

Final Thoughts

The CPI surprise reignited momentum across crypto markets, but Solana Blockchain stands out among altcoins. With unmatched DEX dominance, steady ETF inflows, and expanding adoption, the Solana price outlook appears increasingly compelling as markets search for leadership beyond Bitcoin.