The market stands close to a Solana ETF . Grayscale and Bitwise filed revised S-1 forms with the SEC. Each form adds a staking clause. One senior analyst now expects the agency to sign off within fourteen days.

Why the New Solana ETF Filings Matter

The papers are not a formality; they represent the last required step. The staking clause lets the trust delegate its SOL and pass the rewards to shareholders as cash or extra tokens. The product would track Solana’s price and pay a yield.

Nate Geraci, an ETF observer, notes that the SEC has shortened review times for crypto vehicles. He places early-October approval inside the probable range.

Demand Is Already High

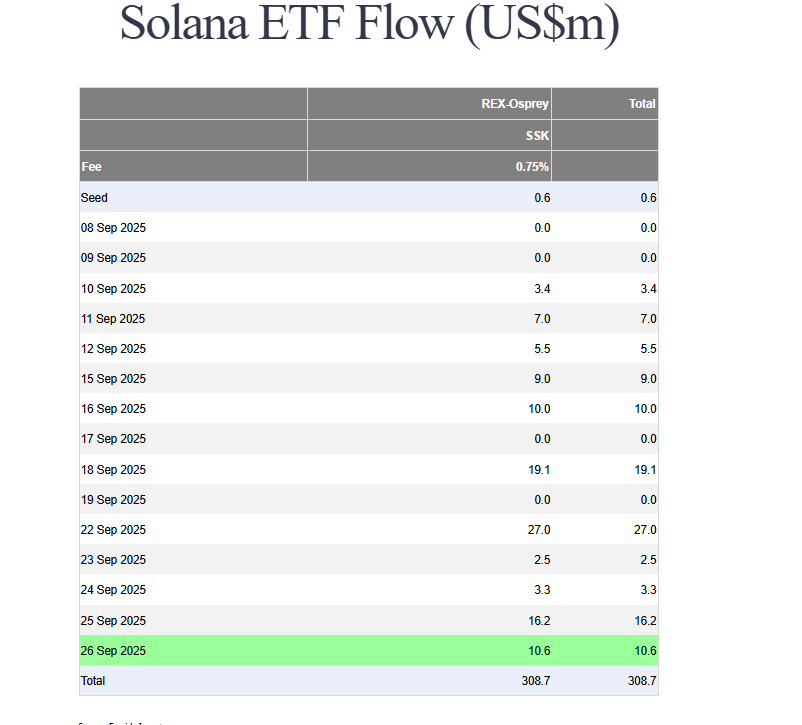

Flow data show strong appetite.

- Bitwise’s European Solana staking ETP attracted a stunning $60 million in inflows in its first week.

- In the U.S., the REX-Osprey SOL ETF saw $10.6 million in a single day and surpassed $308 million in assets under management in just two months.

Institutions want regulated Solana access. A U.S. listing would open a deeper capital pool.

The Countdown

With the final filings submitted and the SEC streamlining its approval process, the stage is set for a historic decision. All signs now point to a potential Solana ETF approval in the first or second week of October. If it happens, it will mark one of the most significant moments for Solana and the entire crypto market this year.