A New Solana ETF Filing is igniting the Solana Ecosystem.

Solana Holds Strong as Fidelity Files for Solana ETF

In a week packed with macro uncertainty, Solana (SOL) is defying the odds, trading steadily around $134 despite broader market declines. This resilience shines as financial behemoth Fidelity Investments—managing $6.4 trillion in assets—drops a game-changing Solana ETF filing with the SEC. This Form 8-A submission is the final administrative step before the product launches, often triggering trading within 24 hours. Meanwhile, Solana’s ecosystem is exploding with growth, thanks to Pump.fun smashing $900 million in all-time revenue. Let’s dive in!

Fidelity’s Solana ETF Filing: The Final Countdown

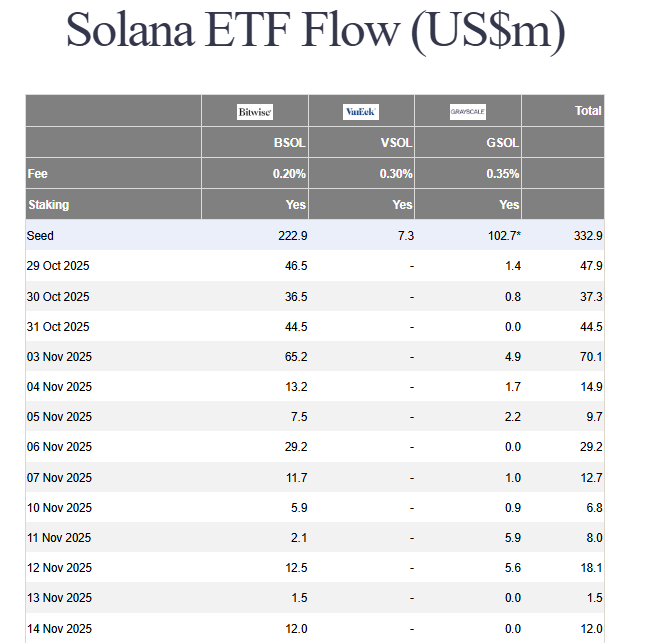

Fidelity’s move places it alongside Bitwise and Grayscale, who already have approved Solana ETFs. Notably, both BSOL and GSOL have recorded zero net outflows since their debut, signaling intense whale accumulation and yield-seeking behavior. This institutional demand is building a solid foundation for SOL prices, even as political tensions mount ahead of a high-stakes congressional vote. For beginners, an ETF (Exchange-Traded Fund) lets investors gain exposure to Solana without directly holding the crypto, making it easier for big money to flow in.

Ecosystem Firepower: Pump.fun’s $900M Milestone

Solana’s momentum isn’t just about ETFs—its native ecosystem is on fire! Pump.fun, a viral token launch platform, has skyrocketed past $900 million in revenue, fueling projects like Fartcoin and Peanut the Squirrel to billion-dollar caps. This highlights Solana’s utility beyond mere speculation, creating a vibrant hub for meme coins and DeFi innovation. Consequently, this organic growth is countering macro headwinds, keeping SOL afloat while other assets wobble.

Technical Outlook: Key Levels to Watch

Currently, SOL trades at $131.53, hovering near the 100-week simple moving average (SMA). The RSI (Relative Strength Index) sits at 27, approaching oversold levels that often precede a bounce. However, the Parabolic SAR indicator remains above price, confirming short-term bearish momentum. Key resistance awaits at $150; a break above could ignite a rally toward the 50-week SMA at $176.55. Conversely, if support fails, the $120 zone may be tested. Traders should watch for ETF news to act as a catalyst.

My Thoughts

This Solana ETF filing is a watershed moment for altcoins, proving that institutional interest extends beyond Bitcoin and Ethereum. Despite macro fears, SOL’s fundamentals—ETFs, ecosystem growth, and yield opportunities—make it a powerhouse poised for a surge. Once political noise fades, expect a violent rally as capital rotates back into high-conviction plays like Solana.