Get ready, crypto degens! The institutional adoption of Solana is accelerating at lightning speed. VanEck has just dropped a bombshell by submitting its final Solana ETF Filing Form 8-A with the U.S. SEC for a spot Solana ETF.

VanEck Solana ETF Filing Triggers Imminent Launch Speculation

This crucial Solana ETF filing is historically the last administrative step before a product starts trading. Consequently, analysts are buzzing that the fund could go live as early as today or the next market session. This move follows VanEck’s earlier S-1 amendment, which revealed a competitive 0.30% management fee and a built-in staking strategy to generate yield for investors—a massive win for passive income seekers.

SOL ETF Inflows Ignite with 13-Day Streak

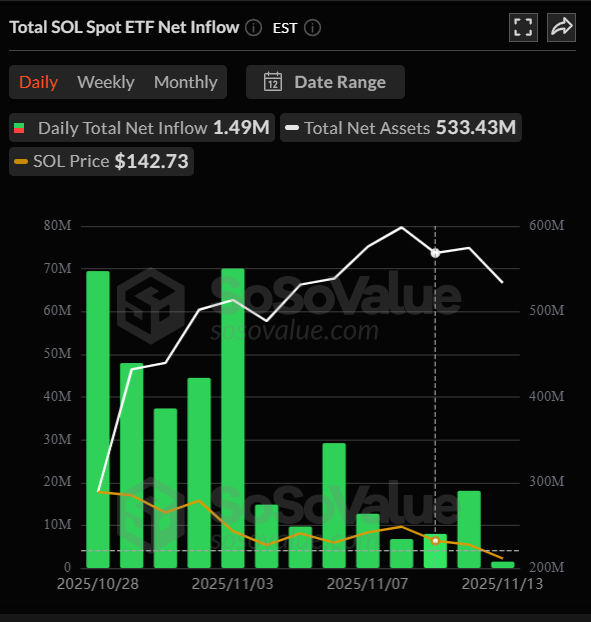

Meanwhile, the demand for Solana ETFs is already going parabolic. Data from SoSoValue shows that spot Solana funds have now recorded 13 consecutive days of inflows, adding another $1.49 million on Thursday. Bitwise’s BSOL continues to lead the charge. Since its launch on October 28, total net inflows have skyrocketed to an impressive $370 million, with nearly $200 million flooding in during the first week alone. Although Thursday marked the lowest inflow day so far, this sustained momentum has wildly exceeded initial forecasts. Nick Ruck of LVRG Research describes SOL ETFs as a “high-beta complement” to Bitcoin and Ethereum funds, offering institutions targeted exposure to Solana’s high-performance ecosystem.

Market Reaction and Advanced Trading Tools

Despite this bullish news, SOL’s price has dipped more than 6% to around $142, likely due to broader market pressures. However, the fundamental outlook remains incredibly strong. In another bullish development, Grayscale has launched options trading for its Solana Trust ETF (GSOL). This opens the door for more sophisticated strategies, further cementing SOL’s position in the institutional toolkit.

My Thoughts

This isn’t just another ETF; it’s a resounding endorsement of Solana’s layer-1 dominance. The relentless inflows and rapid regulatory progress signal that institutions are hungry for altcoin exposure beyond ETH and BTC. VanEck’s imminent launch, coupled with staking rewards, could create a powerful supply shock and propel SOL to new heights once macro sentiment improves. The altcoin season is heating up!