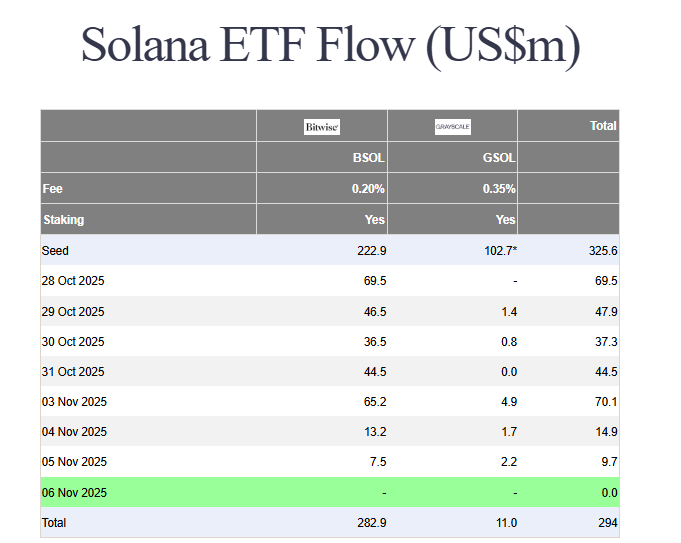

Despite a challenging week for the crypto market, Solana ETF inflows have continued to show strength and consistency.

While Bitcoin ETFs and Ethereum ETFs marked their sixth consecutive day of outflows — with $137 million and $118.5 million withdrawn respectively — the Solana ETF recorded yet another positive day, with $9.7 million in net inflows on November 5th.

Even though this marks its lowest daily inflow since launch, the sustained positive trend — fueled by both Grayscale and Bitwise — underscores growing institutional confidence in Solana’s ecosystem.

Solana ETF Continues Positive Momentum

The Solana ETF posted $9.7 million in net inflows on November 5th, extending its streak of consecutive positive days since launch.

This resilience comes despite broader market outflows and price pressure.

At the time of writing, $SOL is trading steadily around $158, down 15% on a weekly basis, but showing signs of stabilization. The steady accumulation through ETFs suggests that institutional investors are using this dip as an opportunity to increase exposure to Solana’s fast-growing ecosystem.

Notably, both Grayscale’s Solana Trust and Bitwise’s Solana ETF contributed to the day’s inflows — signaling multi-platform confidence in the asset.

Solana’s On-Chain Activity Signals Recovery

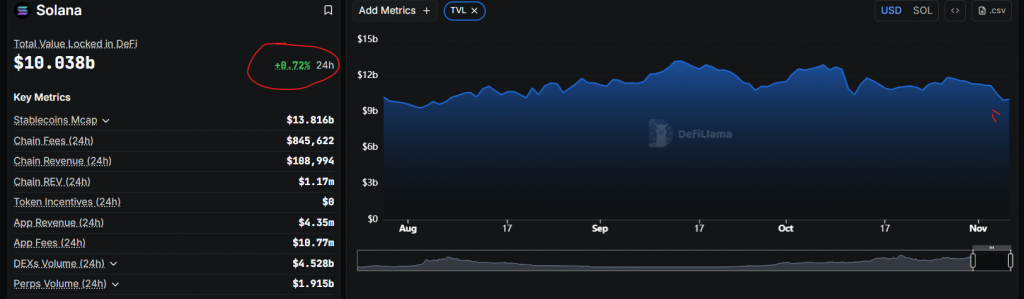

Beyond ETF data, Solana’s on-chain metrics continue to show quiet strength.

The Total Value Locked (TVL) on Solana gained 0.72% over the last 24 hours, a modest but meaningful signal that capital is flowing back into the network after recent market volatility.

Even more impressively, Solana has surpassed both the BNB Chain and Ethereum in DEX trading volume, both over the last 24 hours and the past 30 days.

This milestone highlights Solana’s growing dominance in decentralized trading — a key factor likely driving sustained Solana ETF inflows despite market headwinds.

Institutional Interest Grows Despite Price Drop

Institutional investors appear to be viewing Solana’s short-term price weakness as a long-term opportunity.

The continued Solana ETF inflows indicate strong conviction that Solana’s scalability, ecosystem growth, and increasing DeFi market share position it as one of the most promising altcoins in the current cycle.

While $SOL remains 15% down on the week, its network fundamentals — including TVL growth and DEX leadership — suggest a base is forming for potential recovery once broader market sentiment improves.

Conclusion: Solana ETF Stays in the Green

Even as Bitcoin and Ethereum ETFs experience extended outflows, Solana ETF inflows continue to reflect optimism and faith from institutional investors.

With $SOL holding steady around $158, network activity ticking up, and DeFi participation rising, Solana continues to prove that strong fundamentals can weather even the toughest markets.