Solana ETF Inflows Create Historic 21-Day Demand Streak, Pushing SOL Toward $140

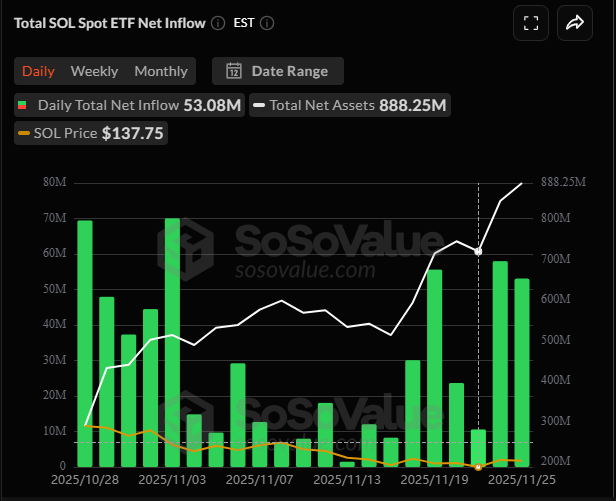

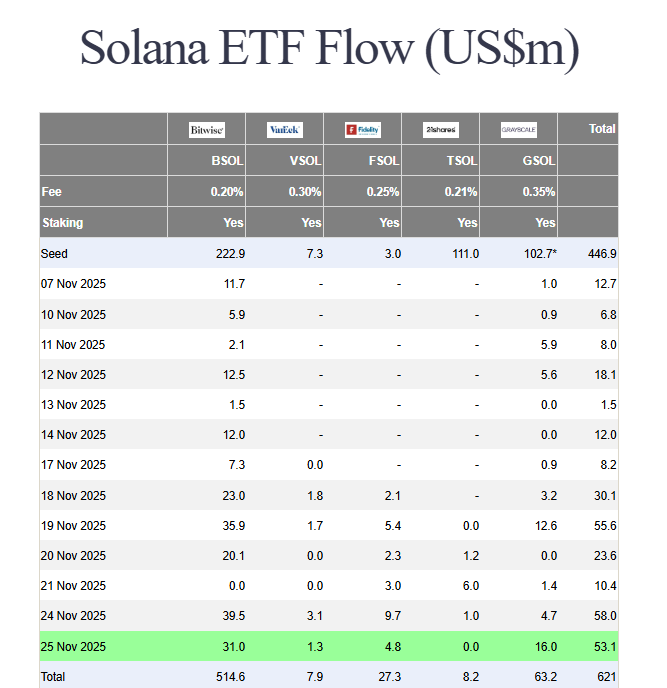

The institutional love affair with Solana is breaking records. Despite a brutal market-wide downturn, Solana ETF inflows have now continued for 21 consecutive days—the longest uninterrupted streak for any major crypto ETF in 2025. This relentless demand injected another $53 million on November 25, bringing total inflows to a massive $621 million. This powerful institutional tailwind is now propelling SOL price toward the critical $140 level, as the network proves its resilience in the face of overwhelming fear.

Franklin Templeton Joins the Solana ETF Inflows Party

The momentum is still accelerating. In a major development, traditional finance giant Franklin Templeton has filed a Form 8-A with the SEC for its own Solana ETF—the final step before launching. The product could begin trading on NYSE Arca as early as November 26. This move places Franklin alongside Bitwise, Grayscale, Fidelity, and VanEck in the Solana ETF arena, creating a formidable wall of institutional products. Bitwise’s BSOL fund continues to lead the pack, pulling in $30.9 million of the latest Solana ETF inflows, while Grayscale’s GSOL added $15.9 million.

The Technical Battle for $140

Solana is currently trading near $139, caught in a tightening compression pattern between a descending trendline and rising support. This often precedes a significant price move. The key level to watch is $140, a historic support and resistance zone. Momentum indicators are finally hinting at a bullish shift. The RSI has formed a bullish divergence after climbing from oversold territory, and the MACD is turning upward. However, spot volume is down 12%, suggesting retail remains cautious. The battle for $140 will be decisive; a clean break above it could trigger a run toward $150 and then $160. If it fails, we may see a retest of the $128-$130 support zone.

My Thoughts

This is institutional conviction in its purest form. While Bitcoin and Ethereum ETFs bleed out, Solana ETF inflows are creating a non-cyclical demand base that is fundamentally reshaping its market structure. The “support floor” identified by researchers is real. Franklin Templeton’s entry is the ultimate validator. I believe the accumulation phase is nearly complete, and when retail FOMO returns, the resulting squeeze could be explosive. The path to reclaiming $200 begins with holding $140.