Solana ETF Inflows Hit Record $58M as Price Surges 5% Toward $150

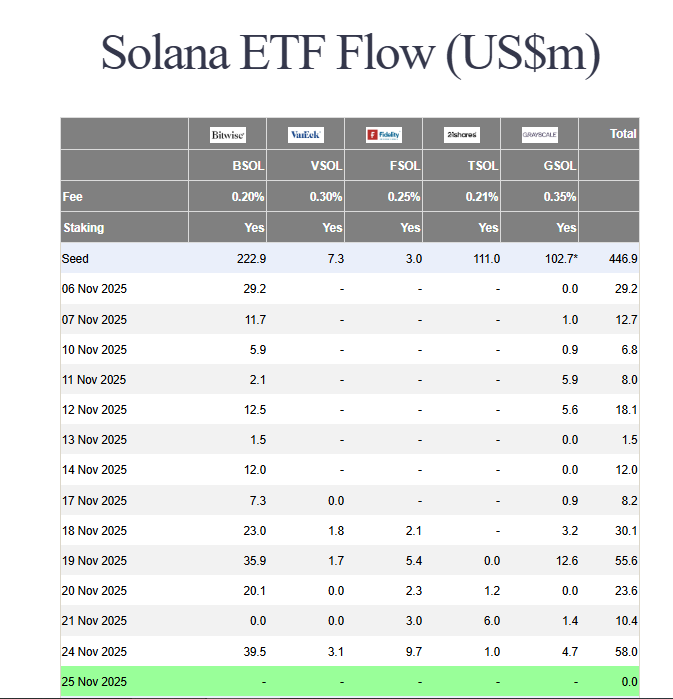

The institutional engine behind Solana is roaring back to life. SOL price surged 5% on Tuesday, punching through $135 as a tidal wave of capital flooded into spot ETFs. The catalyst? A shattering $58 million in Solana ETF inflows on November 24, marking the 20th consecutive day of net positive flows. This brings the total institutional investment to a massive $568 million since late October, proving that smart money is using the dip to build a massive position in the high-speed blockchain.

Bitwise’s Record-Breaking Solana ETF Inflows

The star of the show was the Bitwise Solana ETF (BSOL), which single-handedly attracted a record $39.5 million in a single day—its largest inflow since launch. This relentless accumulation is happening against a backdrop of outflows in the broader crypto market, making Solana a clear standout for institutional favor. This isn’t just a trade; it’s a strategic allocation. The sustained Solana ETF inflows demonstrate that institutions view SOL as a core holding alongside Bitcoin and Ethereum, drawn by its robust ecosystem and high-throughput capabilities.

Solana ETF inflows Source : Farside Investors Franklin Templeton Expands Its Crypto Bet to Include SOL

The bullish case got another powerful boost from traditional finance giant Franklin Templeton. The firm announced its Crypto Index ETF will expand to include Solana, XRP, Dogecoin, and other major altcoins starting December 1, 2025. This is a monumental step, as it provides a fully regulated, diversified pathway for traditional investors to gain exposure to SOL without buying the token directly. This move validates Solana’s market position and is expected to funnel even more capital into the ecosystem, creating a powerful virtuous cycle of demand.

Technical Breakout Eyes the $150 Level

From a technical perspective, the picture is turning bullish. SOL is now testing a crucial resistance level at $140. A decisive break above this barrier could easily open the path to $150. Key momentum indicators support the move. The MACD remains in positive territory, and the Chaikin Money Flow (CMF) indicator shows a reading of 0.11, confirming that money is flowing into the asset. However, traders should remain cautious; a rejection at $140 could lead to a retest of the $130 support level.

My Thoughts

This is institutional conviction in its purest form. The consistent Solana ETF inflows are creating a fundamental supply shock that will dwarf short-term price fluctuations. With Franklin Templeton onboarding traditional investors and technicals lining up, SOL is poised for a major leg up. The $150 target is just the beginning; if the inflows persist, we could see a rally that redefines Solana’s market position heading into 2026.