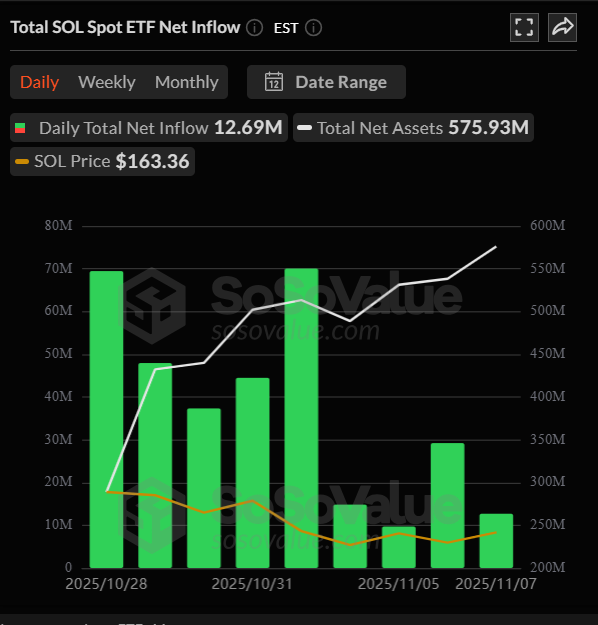

While Bitcoin and Ethereum ETFs flipped back to negative flows on November 7, the narrative for Solana was markedly different. Solana ETF inflows continued, with $12.69 million added in one day — lifting total assets under management to $575.93 million and closing the week with $136.5 million in net inflows. Given the broader market headwinds this week, that streak is a notable show of strength.

Solana ETF Inflows: Day-by-Day Resilience

The Solana ETF’s $12.69M one-day net inflow on November 7 may be smaller than the early launch highs, but it kept the product firmly in positive territory. With $575.93M AUM, the fund has shown sustained appetite from institutional and investor channels even when flagship ETFs wobble. The weekly net inflow of $136.5M — while below the ETF’s opening-week peak — remains a strong performance given the market’s churn.

Price Action: Volatility, Then Recovery

Solana’s price moved sharply intraday: from a low of $149.81 to a high of $163, and it has since cooled to trade around $160. That intraday bounce, combined with continued ETF buying, suggests that capital is treating dips as accumulation windows rather than panic exits.

On-Chain Signals: TVL and DEX Leadership

On-chain metrics back the ETF story:

- Solana TVL (per DeFiLlama) returned above $10 billion, showing a ~2% gain over 24 hours — a sign that liquidity and use-case activity are returning.

- Solana leads DEX trading volume both for the last 24 hours and the last 30 days, outperforming BNB Chain and Ethereum in DEX volume.

- Additionally, Solana trading volume and futures Open Interest both rose yesterday, underlining renewed market participation and derivative interest around SOL.

Together, these metrics explain why Solana ETF inflows have held up: investors are seeing real, on-chain activity and trader engagement, not just price moves.

Why This Matters

- Divergence from BTC/ETH flows: While Bitcoin and Ethereum ETFs experienced outflows on Nov 7, Solana’s continued inflows indicate a diversification trend among institutional allocations.

- Fundamental support: Rising TVL and DEX leadership give the asset a fundamentals-based bid beyond speculative momentum.

- Market structure: Positive ETF flows can provide a steady demand sink for SOL supply during volatile periods, supporting price floors.

Conclusion

In a week where macro headlines and ETF rotations pressured the market, Solana ETF inflows stood out as a bright spot. With $12.69M added on November 7, $575.93M AUM, TVL back above $10B, and DEX volumes leading the pack, Solana’s ecosystem — and its ETF — are showing resilience. Investors watching for the next phase of institutional diversification should keep an eye on SOL’s on-chain metrics and continued ETF demand.