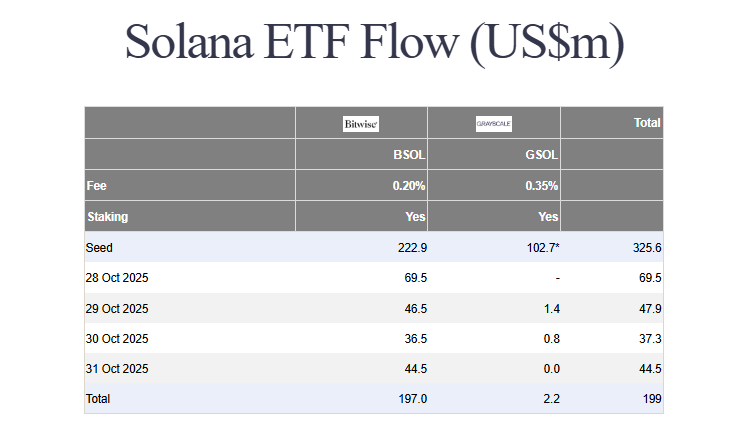

While the crypto giants bleed, Solana is quietly executing a masterclass in capital attraction. Solana ETFs have just secured their fourth consecutive day of positive inflows, adding another $44.4 million on Friday. This brings the total assets under management (AUM) to a staggering $199 million, with over half a billion dollars in total assets. This relentless demand is creating a powerful divergence in the market, as capital visibly rotates from legacy assets into the Solana ecosystem.

The Great Rotation: Capital Flees BTC and ETH for SOL

The data tells a compelling story of shifting allegiances. On the same day Solana ETFs pulled in $44.4 million, Bitcoin ETFs witnessed a devastating $191 million outflow. Ethereum funds didn’t fare much better, bleeding $98 million. This isn’t a coincidence; it’s a trend. The Bitwise Solana ETF (BSOL) is leading the charge, proving itself as the dominant vehicle for this institutional pivot. This massive rotation suggests that smart money is betting on Solana’s higher growth potential in the current cycle.

Analyst Eyes $300 as SOL Holds Critical Support

So, what does this mean for the SOL price? Despite a minor dip, the token is holding firm above $185, consolidating in a tight range between $180 and $190. Prominent analyst Ali Martinez has identified that SOL is trading above a key support zone backed by the 200-day simple moving average. This is a critically bullish foundation. He argues that with increased buyer participation, this consolidation could spark the next leg up, potentially propelling SOL toward $240 and even a ambitious $300 target.

The Technical Crossroads: Breakdown or Breakout?

The immediate future hinges on a key technical battle. The RSI sits at a neutral 42, while the MACD indicates lingering bearish momentum. If the $185 support cracks, a drop to $180 is likely. However, the sheer weight of the ETF inflows provides a fundamental counterbalance to this technical weakness. A decisive break above the $190 resistance could be the trigger that sends SOL racing toward $200, confirming a strong reversal and setting the stage for a much larger rally.

My Thoughts

This is institutional alpha playing out in real-time. The Solana ETFs flow data doesn’t lie—capital is seeking the highest growth narrative, and right now, that’s Solana. The steady inflows are building a launchpad for the next major move. While the short-term charts look messy, the fundamental picture has never been stronger. I’m betting the inflows win this tug-of-war.