In a significant shift in the crypto hierarchy, Solana (SOL) has officially surpassed Binance Coin (BNB) to become the fifth-largest cryptocurrency by market capitalization. This milestone comes as SOL’s price tests the $240 level, fueled by a powerful combination of technical breakout strength and overwhelmingly positive fundamental developments.

The Technical Breakout

SOL’s journey to this flip began with a decisive technical breakout. The coin successfully shattered the key $205-$210 resistance band, which aligned with the 0.382 Fibonacci retracement level.

Since then, it has consistently printed higher lows, demonstrating sustained buying pressure. This momentum has now carried the price to $240, a level not seen since late January.

However, the rally may be due for a breather. The RSI is nearing 70, signaling overbought conditions. A pullback toward support at $218 or the $208-$210 zone (a combination of the 20-day EMA and Fib level) would be healthy and could set the stage for the next leg up toward $260.

Fundamental Fuel: Record-Breaking Demand

This price surge isn’t just technical; it’s built on a rock-solid fundamental foundation.

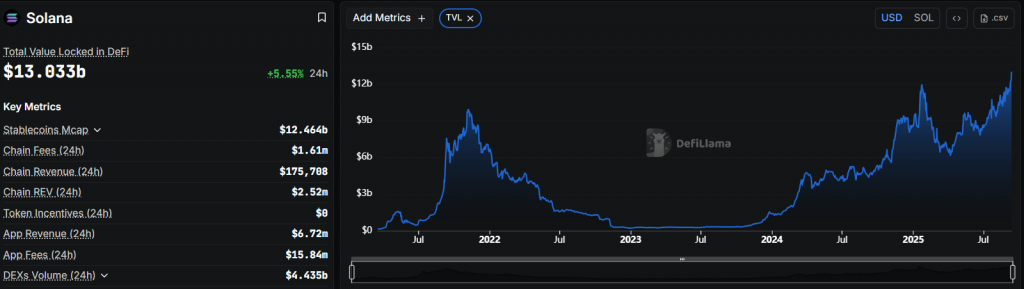

- Record DeFi TVL: The Total Value Locked (TVL) on Solana has soared to a record $12.95 billion—a 20% increase in just 30 days. This figure now surpasses the combined TVL of Ethereum’s major Layer-2s (Base, Optimism, and Arbitrum).

- Memecoin Explosion: The total market cap of Solana-based memecoins has exploded to $13 billion, up from $7.3 billion in late June—a 80% surge in under three months.

- Corporate Adoption: Solana is becoming a favorite for corporate treasuries. 13 publicly listed companies now hold SOL in their reserves, a number that continues to grow.

The Bottom Line

Solana’s flip of BNB is more than a symbolic milestone; it’s a testament to its powerful and growing ecosystem. The combination of a vibrant DeFi scene, a dominant memecoin sector, and rising institutional interest creates a compelling bullish narrative.

While a short-term pullback is likely due to overbought conditions, the overall trend remains powerfully upward. For SOL, the path to $260 and beyond appears clear as it solidifies its position as a top-tier blockchain and a serious competitor to Ethereum.