Solana is charging toward the critical $200 level, fueled by growing institutional demand and strong network fundamentals. The Solana price jumped to $195, up 12% from its monthly low, as a key staking ETF recorded another week of major inflows.

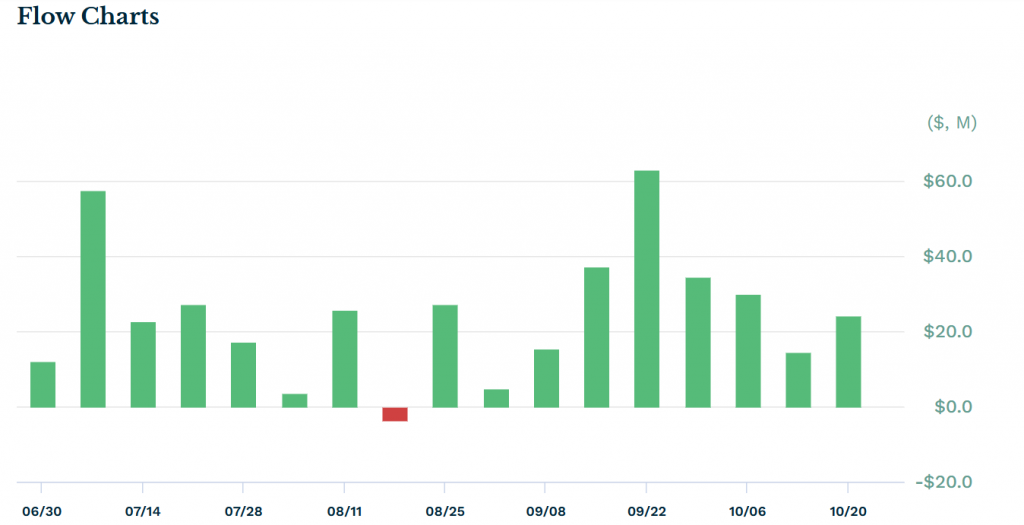

The REX-Osprey Staking Solana ETF (SSK) pulled in $24 million this week, boosting its assets under management to over $400 million. This consistent institutional interest, especially during a bear market, signals that Wall Street sees long-term value in Solana. Furthermore, it bodes well for the spot Solana ETFs filed by giants like VanEck and Fidelity, which JPMorgan predicts could attract $6 billion in their first year.

Network Strength Supports the Solana Price Rally

The bullish case isn’t just based on speculation. Solana’s network is demonstrating incredible strength. Its stablecoin supply grew 14% in the past month to $15.6 billion. Meanwhile, adjusted transaction volume soared 55% to $48 billion. In the DEX arena, Solana is nearly tied with Ethereum, processing $140 billion in volume over 30 days compared to Ethereum’s $148 billion.

Technically, the Solana price is in a strong position. It has held above a key ascending trendline and formed a triple-bottom pattern, a classic bullish reversal signal. The path of least resistance is now upward, with the next major target at $205.

My Thoughts

This is the institutional validation Solana bulls have been waiting for. The ETF inflows prove that demand exists beyond retail speculation. With a spot ETF likely approved soon, Solana is positioning itself as the clear #3 institutional asset after Bitcoin and Ethereum. The combination of strong technicals, institutional flows, and robust on-chain activity creates a powerful bullish setup. A break above $205 could unleash a FOMO rally back to all-time highs.