Solana Price Analysis: Reversal in Play as Franklin Templeton ETF Launches

Our latest Solana price analysis reveals an explosive 11% rebound, with SOL decisively breaking above $135 and a key bearish trend line. This surge coincides with a major institutional catalyst: the final approval of the Franklin Templeton Solana ETF (SOEZ) on NYSE Arca. The digital asset is now at a major inflection point, trading above its 100-hour moving average and eyeing a critical resistance zone that will determine its near-term trajectory.

Technical Setup Signals a Bullish Shift

The charts show a clear narrative. SOL has broken out from a descending wedge pattern on the hourly chart, a classic reversal signal. The bullish move is confirmed by a MACD crossover into positive territory and an RSI holding firmly above 50, indicating growing momentum. The immediate hurdle is the resistance cluster between $138 and $142. A daily close above this zone could ignite a run toward $150 and beyond. However, failure here might see a retest of the newfound support near the $130 breakout level.

The ETF Catalyst: Franklin Templeton Enters the Arena

Timing is everything. This technical breakout aligns perfectly with the official green light for Franklin Templeton’s spot Solana ETF. The fund, set to trade under ticker SOEZ, represents a massive vote of confidence from a traditional finance titan. While the broader Solana ETF segment saw outflows recently, Franklin’s entry expands the total addressable market, providing a new, regulated conduit for institutional capital. This fundamental development underpins the technical strength.

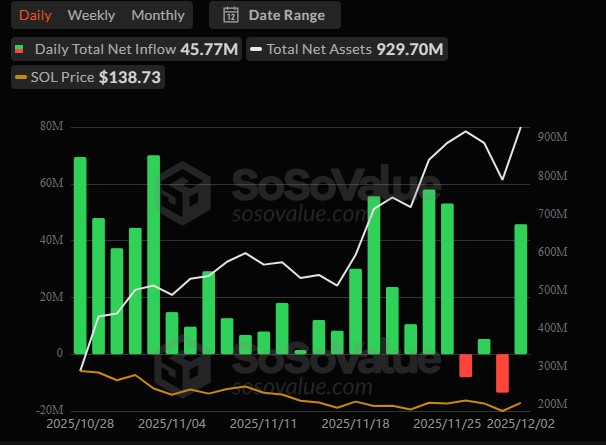

Solana ETF recorded also, a positive Net inflow on December 2nd of $45.77 Million coming mainly from the Bitwise BSOL ETF with $29.4M and the Grayscale GSOL ETF with $6.3M.

Institutional Activity Shows Deep Conviction

Beyond ETFs, institutional commitment to the Solana ecosystem is deepening at a remarkable pace. Forward Industries is converting 1.7 million SOL (worth over $230 million) into a liquid staking token (fwdSOL) for advanced DeFi yield strategies. This move, following their initial $1.6 billion treasury allocation, demonstrates sophisticated capital deployment beyond simple holding. It signifies a long-term belief in Solana’s utility and its staking economy.

My Thoughts

This is a powerful convergence of momentum. The technical breakout is being validated by a fundamental inflow of institutional credibility and capital. Franklin’s ETF isn’t just another listing; it’s a signal that major asset managers see SOL as a core crypto asset alongside BTC and ETH. The sophisticated staking strategies being employed by public companies like Forward Industries further validate the network’s utility. The path of least resistance is now upward, provided SOL can conquer the $142 wall. If it does, bullish fireworks could follow.