The Solana price rebound is underway, but it’s approaching a make-or-break moment. After a brutal sell-off on November 3 pushed SOL below its long-term ascending channel—a pattern that had held strong since April—the price found a foothold near $146.

Solana Price Rebound Attempt Faces Ultimate Test at $166

The subsequent bounce is now attempting to reclaim lost territory, but it’s running directly into a massive wall of resistance. The fate of this recovery hinges entirely on the battle at the $166 to $169 zone, a level packed with technical significance that will determine if bulls have the strength to repair the recent damage.

The Confluence of Resistance: Why $166-$169 is Critical

This isn’t just any resistance level; it’s a technical perfect storm. The $166-$169 zone represents a “Support-Resistance flip,” where a previous support level now acts as resistance. It also coincides with the 21-day Exponential Moving Average (EMA) and the 0.786 Fibonacci retracement level of the recent drop. When this many technical indicators align at a single price point, it creates a powerful barrier. A decisive daily close above this zone would be a strong signal that the Solana price rebound has real momentum and could next target the 55-day EMA near $190, which also aligns with the lower boundary of the broken ascending channel.

Bullish Catalysts Providing a Tailwind

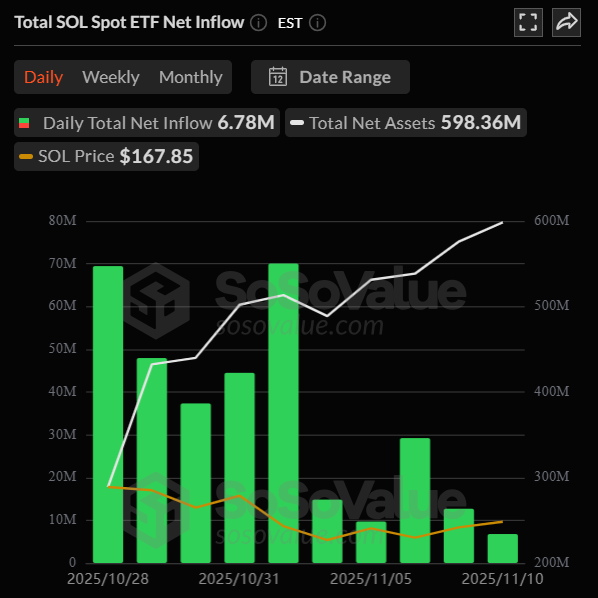

Despite the technical damage, fundamental tailwinds are supporting the Solana price rebound. Solana ETFs have recorded consistent inflows for 10 consecutive days, proving that institutional demand remains resilient even during market downturns. They recorded a net Inflow on Nov 10of $6.78M even though $BTC ETF recorded a $1.2M net inflows and $ETH ETF a $0M

Furthermore, the impending resolution of the U.S. government shutdown is restoring overall risk appetite across financial markets. If Bitcoin and Ethereum can find their footing and lead a broader market recovery, SOL, as a high-beta asset, is perfectly positioned to outperform on the way up.

The Outlook: Two Scenarios for Solana’s Next Move

Traders are now watching two clear scenarios unfold. The bullish scenario requires SOL to powerfully break and hold above $169. This would open a clear path for a run toward the $190 level and an attempt to reclaim its position within the ascending channel. The bearish scenario triggers if the $166-$169 resistance holds strong and price is rejected. In this case, a retest of the $146 support level becomes likely, and a break below that could signal a much deeper correction.

My Thoughts

This is a pivotal moment for SOL. The technical breakdown was severe, but the resilience shown by holding $146 and the constant ETF inflows are hugely encouraging. I believe the odds favor the bulls here. The institutional accumulation via ETFs is creating a underlying bid that wasn’t present in previous cycles. If SOL can reclaim this zone, it will signal that the correction was a healthy flush-out, not a trend reversal.