Sui Price Reversal Shows Early Signs of a Potential Trend Reversal

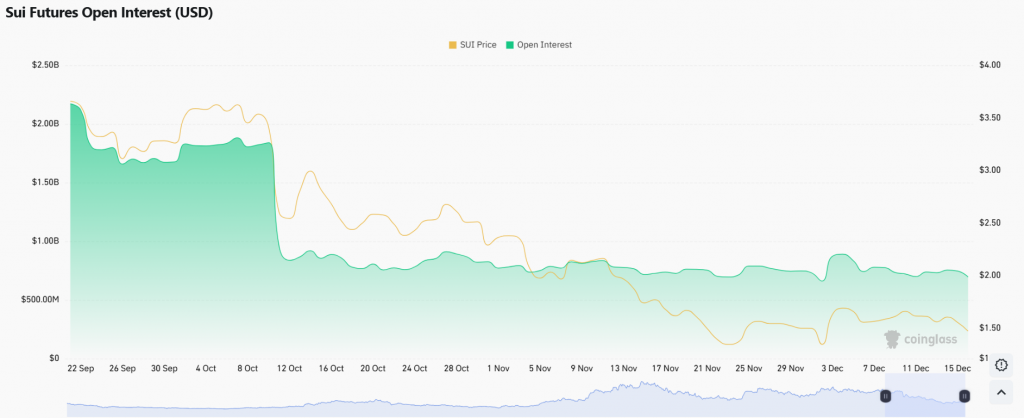

Sui (SUI) is flashing intriguing signals that have traders on high alert. After a tough downtrend, the price is now consolidating tightly around a crucial support level of $1.31. Notably, this pause coincides with a clear decline in open interest across derivatives markets. This combination often suggests that bearish momentum is fading, which raises the possibility of a significant Sui price reversal in the making.

Key Technical Signals to Watch

Currently, Sui is stabilizing at a major high-time-frame support level. This area aligns with the Point of Control (POC)—the price where the most historical trading volume has occurred. Think of it as a magnet for price during consolidation phases.

Moreover, the falling open interest is a critical data point. Typically, this indicates that leveraged short positions are being closed. In other words, bears are taking profits and losing their aggressive stance. This doesn’t guarantee an immediate surge, but it absolutely weakens the downward pressure and creates space for buyers to step in.

The Path to a Confirmed Recovery

For a full bullish reversal to be confirmed, Sui needs to achieve two things. First, it must firmly reclaim and hold above the POC support zone. Second, we would need to see a surge in buying volume and a subsequent rise in open interest, signaling fresh capital entering the market.

The next major target for any sustained recovery sits at the $2.99 resistance level. Reaching that zone would strongly indicate the downtrend has decisively broken. Adding a fundamental tailwind, the recent partnership between SAGINT and Sui for a tokenization initiative provides a positive backdrop for this technical repair.

Market Outlook: Consolidation Before a Potential Move

In the short term, expect Sui to continue its consolidation near $1.31. This is a healthy process for the market to build a new base. The rapidly declining bearish momentum is the most promising sign here. However, patience is key; traders should watch for a conclusive break above consolidation with strong volume to signal the next major move.

My Take

The setup here is compelling for a potential swing trade. When Sui price reversal holds a key level and derivatives data shows capitulation from the dominant side (bears), it’s time to pay close attention. The risk/reward for a long entry here is improving, though confirmation is still needed. This is a classic “base-building” structure that often precedes significant moves.