Crypto whales are positioning for potential turbulence as Federal Reserve Chair Jerome Powell prepares to deliver a crucial economic outlook speech today. Significant whales shorting altcoins have emerged across major derivatives platforms, revealing sophisticated traders are bracing for possible market weakness following Powell’s comments on monetary policy.

Whales Shorting Altcoins Ahead of Powell Speech

According to on-chain data from LookOnChain, several large traders have established substantial short positions totaling hundreds of millions of dollars. One particularly active whale, identified as 0x9eec9, currently holds $98 million in short positions across DOGE, ETH, PEPE, XRP, and ASTER. This trader has already recorded $31.8 million in realized profits from previous positions.

Meanwhile, another whale (0x9263) with $13.2 million in historical profits maintains $84 million in short positions targeting Solana and Bitcoin. Most notably, a Bitcoin OG whale has dramatically increased its BTC short position to $492 million, currently showing $9 million in floating profits. These coordinated moves suggest experienced traders anticipate potential downside following Powell’s remarks.

Market Context and Economic Concerns

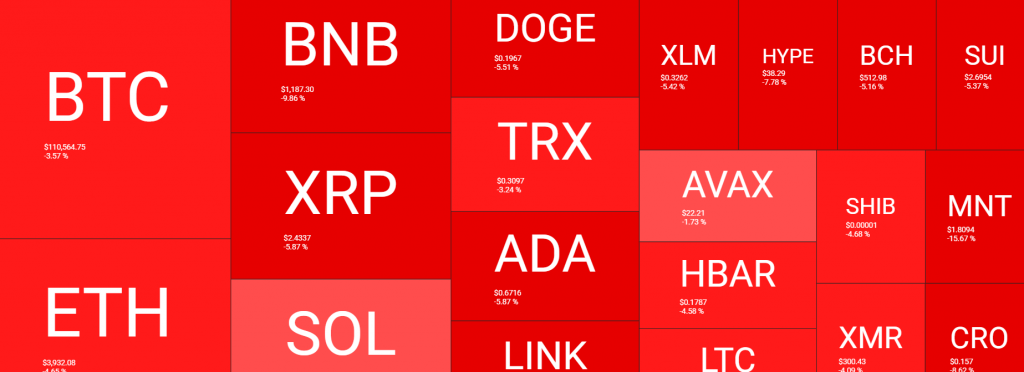

Powell’s scheduled speech at the National Association for Business Economics meeting comes during heightened market sensitivity. Recent trade tensions between the U.S. and China have already triggered volatility, with Bitcoin declining 2.88% and Ethereum falling below $4,000. The Crypto Fear and Greed Index has plummeted to 27, its lowest level in six months.

Market analysts suggest whales shorting altcoins may be anticipating a “hawkish” tone from Powell that could delay expected rate cuts. Such a development would tighten liquidity and potentially pressure risk assets like cryptocurrencies. Lebanese-Australian entrepreneur Mario Nawfal specifically warned traders about potential “volatility” following the speech.

My Thoughts

These substantial short positions represent both hedging and speculative bets against Powell delivering hawkish commentary. While the positions are large, they also create potential squeeze scenarios if Powell strikes a more dovish tone than expected. Retail traders should prepare for volatility regardless of direction, as these whale positions will need to unwind eventually.