The Great Divergence: XRP ETF Inflows Defy a Bleeding Market

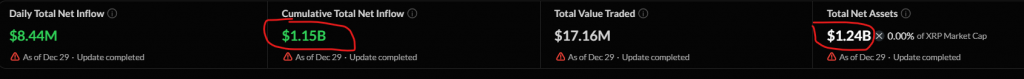

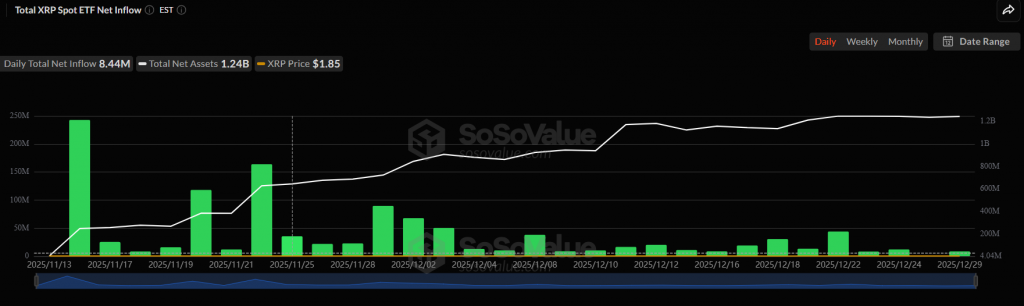

While the broader market panicked in December, smart money quietly placed a massive, consistent bet. U.S. spot XRP ETF inflows have now continued for 29 consecutive days, amassing $1.15 billion in total inflows since launch. This relentless accumulation stands in stark contrast to Bitcoin and Ethereum ETFs, which bled over $1.1 billion and $612 million, respectively, during the same period. This isn’t just a trend; it’s a powerful signal of where institutional capital sees differentiated, long-term value.

XRP ETF Inflows: A Story of Steady, Strategic Accumulation

The data is compelling. On Monday alone, XRP ETFs pulled in another $8.44 million, bringing total net assets to $1.24 billion. This consistency is key—throughout a month of market volatility and year-end selling, XRP funds never saw a single day of outflows.

Analysts like Vincent Liu of Kronos Research attribute this to XRP’s unique regulatory clarity and its cross-border settlement use case. Institutions are accumulating a “less crowded trade” that offers exposure distinct from the broader crypto beta of BTC and ETH. This is strategic, long-horizon capital building a position, not speculative hot money.

The Big Picture: Bitcoin & ETH ETFs See Year-End Exodus

The contrast couldn’t be sharper. Spot Bitcoin ETFs endured their worst outflows since launch, with a single-day withdrawal of $357.7 million on December 15th. Ether ETFs followed a similar path. Glassnode notes the 30-day moving average for flows has been negative since early November, indicating a broader cooling of institutional demand and liquidity contraction.

However, some experts caution against overreading the year-end exodus, attributing it to “holiday positioning” and thin liquidity. The true test will be if flows normalize as institutional desks return in January.

What This Means for the 2026 Narrative

This divergence reshapes the 2026 outlook. XRP ETF inflows demonstrate there is dedicated, bullish capital specifically targeting XRP’s niche. Meanwhile, Bitcoin may trade in a “range-bound bull market,” sensitive to macro shifts, while Ethereum’s fate is tied to network utility adoption.

My Thoughts

This is a masterclass in sector rotation within crypto. Institutions aren’t leaving; they’re reallocating. The sustained XRP ETF inflows reveal a sophisticated bet on a specific, real-world utility narrative that has clearer regulatory guardrails. For traders, this is a massive clue: while the crowd focuses on Bitcoin’s price, the smart money is building in XRP. This creates a strong fundamental floor and a powerful catalyst for when broader market sentiment turns. XRP is being institutionalized on its own merits.