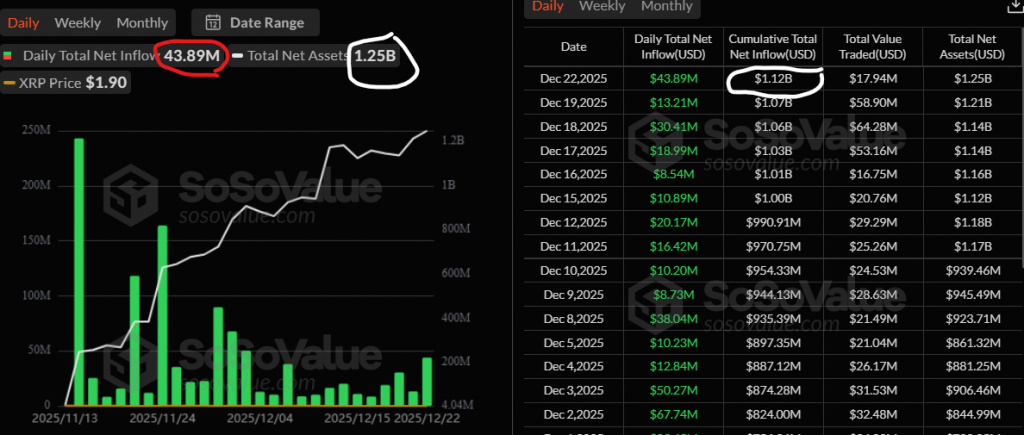

Institutions Are Buying: XRP ETF Inflows Surge Past $1.12 Billion

While retail panics, the smart money is loading up. Despite trading below the key $2 level, XRP is witnessing massive institutional accumulation, with U.S. spot ETFs buying a staggering $1.12 billion worth of tokens over the past five weeks. This wave of XPR ETF inflows isn’t a one-off spike; it’s sustained, heavy demand that reveals deep conviction during a market-wide pullback. Combined with the XRP Ledger processing its 4 billionth transaction, the fundamentals are screaming bullish.

Decoding the Massive XRP ETF Inflows

The data is clear and powerful. ETF buying has escalated through November and December, pushing total assets in XRP-focused funds well over the billion-dollar mark. Crucially, this buying persisted even as the price consolidated around $1.90, showing institutions are using market weakness to build strategic positions.

This trend is a major divergence from short-term sentiment. It signals that large, sophisticated capital views XRP as a long-term infrastructure play, not a short-term trade. For traders, this creates a formidable support floor; when institutions accumulate at these levels, they tend to defend them.

A Historic Network Milestone Meets Key Technicals

The fundamental case strengthens by the day. The XRP Ledger just processed its 4 billionth transaction, a testament to its relentless, real-world utility for fast, low-cost settlements. As Ripple’s CTO noted, this network growth is a truer measure of value than daily price swings.

Technically, XRP is range-bound between strong support at $1.80 and major resistance at $2.00. A decisive daily close above $2.00 could trigger a swift move toward $2.20. While the RSI and MACD show near-term bearish pressure, the massive XRP ETF inflows provide a powerful counterbalance to technical weakness.

My Thoughts

This is the most bullish XRP setup in months. The XRP ETF inflows story is being overlooked, but it’s monumental. Institutions don’t park over a billion dollars on a whim. They see the regulatory clarity, the ledger’s utility, and an asset trading at a steep discount to its potential. The $2 level is now a psychological and technical magnet. Once it breaks, the combination of institutional fuel and proven network effects could launch a much larger rally. My move? Watch for a volume-backed close above $2.00 as the confirmation signal.