XRP ETF Inflows Explode with $164M Surge as Price Rallies 8%

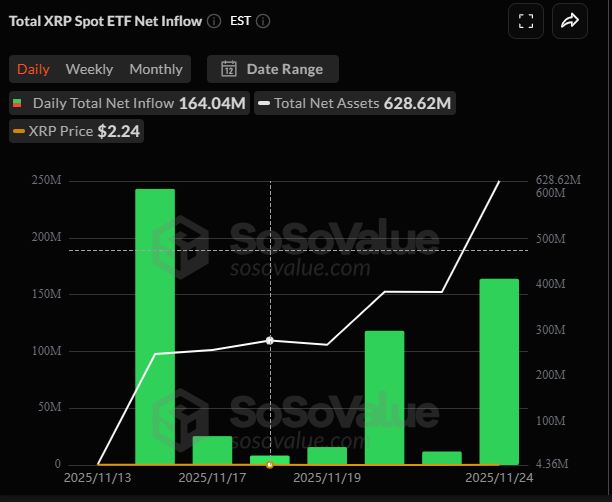

The institutional floodgates are officially open. XRP spot ETFs just recorded a monumental $164 million in net inflows on November 24—the second-largest single-day haul since their launch. This massive wave of XRP ETF inflows instantly translated into price action, propelling the token over 8% as institutional capital overwhelmed selling pressure. The rally comes as new heavyweight entrants like Grayscale’s GXRP and Franklin Templeton’s XRPZ made their market debut, signaling that the demand for regulated XRP exposure is far from saturated.

Breaking Down the Massive XRP ETF Inflows

The data reveals an institutional feeding frenzy. Grayscale’s newly launched GXRP fund led the charge with a staggering $67.36 million inflow, while Franklin Templeton’s XRPZ followed closely with $62.59 million. This marks the seventh consecutive day of inflows for the nascent ETF sector, proving the demand is sustained, not a one-off event. The pioneer fund, Canary’s XRPC, has now ballooned to $306 million in total assets. This relentless institutional accumulation is creating a fundamental supply shock on exchanges, directly fueling the price recovery.

The Stunning Supply Shock Thesis

The real story isn’t just today’s number—it’s where this is headed. Prominent analyst Chad Steingraber laid out a breathtaking thesis, comparing the current XRP ETF inflows to Bitcoin’s early ETF days. He notes that BTC ETFs eventually saw multiple $1 billion inflow days. For XRP, with 12 active funds, a collective $1 billion day would require just over $83 million per fund—a target already within reach. Steingraber projects that a five-day run of such inflows could remove a staggering 2.2 billion XRP from circulation in less than a week. The consequence? “The only variable that changes the equation is price,” he states. The XRP price must skyrocket to balance this explosive demand against finite supply.

My Thoughts

This is the clearest validation of the institutional XRP thesis we’ve seen. The XRP ETF inflows are not just strong; they are accelerating. We are witnessing the very early stages of a supply squeeze that could dwarf all previous price cycles. With more ETFs from 21Shares and CoinShares launching imminently, the buying pressure is set to intensify. For investors, this is a rare moment where the on-chain data, flow data, and technicals are all aligning for a historic move.