Institutional Engine Roars: XRP ETF Inflows Power 10% Weekly Rally

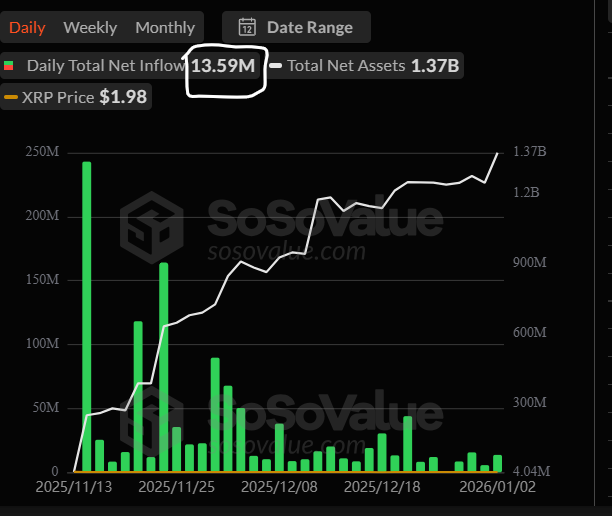

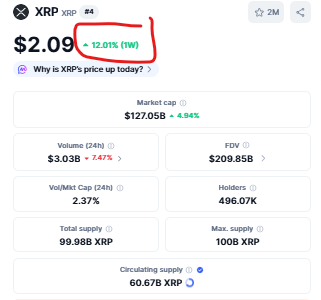

The institutional validation is undeniable. XRP isn’t just rallying; it’s being propelled by a massive wave of regulated capital. Sustained XRP ETF inflows added another $13.6 million on Friday, pushing the total net inflow toward a staggering $1.20 billion. This relentless institutional demand is the core engine behind XRP’s 12% weekly surge, which saw it decisively flip BNB to become the world’s third-largest cryptocurrency.

This rally is particularly impressive because it held strong even amid geopolitical tension following the U.S. action in Venezuela. While other assets might have faltered, XRP’s price climbed 6% in a day to breach $2.09, demonstrating strength that extends beyond general market sentiment. The ETFs are providing a constant baseline of buy-side pressure, turning previous resistance levels into new support.

Key Resistance Awaits Despite Strong XRP ETF Inflows

However, the path forward now faces clear technical tests. With the price near $2.10, XRP is approaching significant sell walls that could temporarily halt momentum. The immediate resistance sits around $2.17, followed by another key level just above $2.25. A daily close above these zones is critical for the rally to continue its leg up.

Some analysts urge caution, noting the recent daily candle closed “indecisively.” The priority for bulls is to push higher and avoid a fall back to test the $1.97 support level. The sheer scale of the XRP ETF inflows provides a strong fundamental cushion, but overcoming this technical overhead supply is the next challenge.

My Thoughts

This is a textbook case of fundamentals (ETF inflows) driving a technical re-rating (flipping BNB). The $1.2 billion inflow figure is a monumental vote of confidence from the regulated financial world, effectively debunking the “security” overhang that plagued XRP for years. While short-term technical resistance is natural after such a run, the institutional accumulation creates a much higher price floor. This isn’t speculative retail money; it’s strategic allocation that likely won’t flee on minor volatility.