XRP ETF Inflows Explode with Record $199M Weekly Start

The institutional dam has broken. XRP spot ETFs have opened the new week with an absolute explosion of capital, racking up a staggering $199.45 million in net inflows across just two trading days. This monumental start has already eclipsed the entire previous week’s total of $179.60 million, signaling a massive acceleration in institutional adoption. The relentless XRP ETF inflows prove that demand for regulated exposure is not just strong—it’s growing at a breakneck pace.

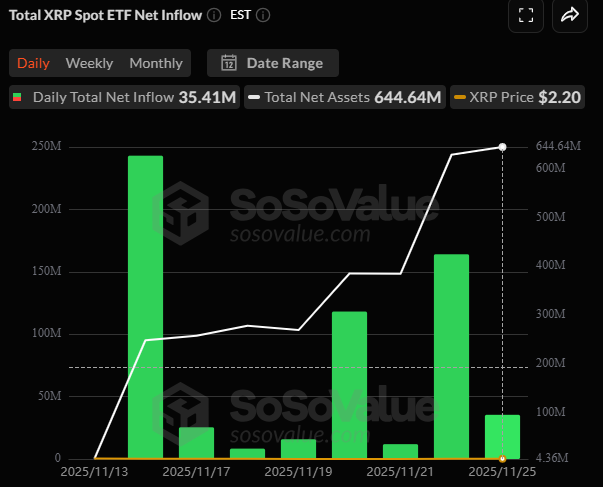

Breaking Down the Record XRP ETF Inflows

The data from SoSoValue reveals a powerful, broad-based buying spree. On Monday, November 24, issuers hauled in a colossal $164.04 million. This was followed by another solid $35.41 million on Tuesday. The cumulative effect propelled total net assets for all XRP ETFs to $644.64 million. What’s most impressive is the consistent participation across all major issuers. Bitwise led the latest day with $21.30 million, while Canary and Franklin Templeton added $6.99 million and $7.12 million respectively. This isn’t one fund carrying the weight; it’s a unified institutional front.

Institutional Demand vs. Price Action: The Coming Squeeze

Despite this flood of capital, XRP’s price has remained curiously range-bound between $2.16 and $2.29. This creates a fascinating divergence: institutions are accumulating aggressively through ETFs, yet the spot price has yet to react. This phenomenon often precedes a major supply shock. Trading volume for the ETFs has also jumped to nearly $44 million per session, up significantly from the $20-25 million range seen in early November. All the pieces are in place for a significant price move; the XRP ETF inflows are building immense pressure beneath a stagnant surface.

My Thoughts

This is the most bullish signal for XRP since the ETFs launched. The fact that inflows are accelerating shows that institutions are far from done building their positions. The disconnect between price and demand is unsustainable. When this institutional buying finally overpowers the spot market’s inertia, the resulting squeeze could be explosive. We are likely witnessing the calm before a monumental storm. For investors, this is a clear accumulation signal.