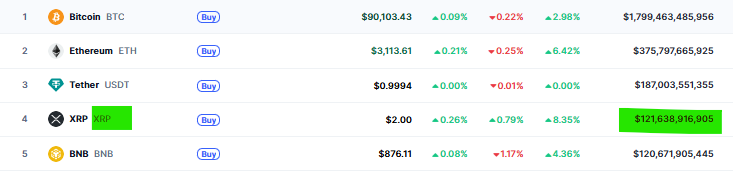

Market Cap Madness: XRP Flips BNB in Historic Reshuffle

The crypto rankings have just witnessed a seismic shift! In a stunning display of strength, XRP flips BNB to become the third-largest cryptocurrency by market capitalization. This monumental move, driven by powerful ETF inflows and a major technical breakout, signals a dramatic resurgence of confidence in the long-debated token.

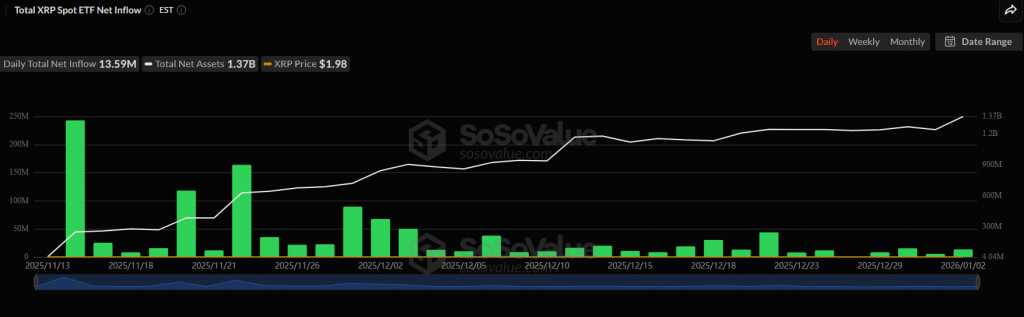

The rally isn’t happening in a vacuum. It’s being fueled by two powerful jets: institutional money and technical momentum. First, U.S. spot XRP ETFs recorded another $13.6 million in net inflows, extending a remarkable streak. Second, and perhaps more critically, XRP has decisively broken out from a punishing 8-month descending channel on the weekly chart—a classic technical signal that the long correction is over.

The Dual Engine Behind XRP’s Ascent

Let’s break down these twin catalysts. The ETF inflows, while smaller than Bitcoin’s, prove that regulated, institutional demand for XRP is real and growing. This provides a solid foundation of buy-side pressure beyond retail speculation.

Simultaneously, the technical picture has turned explosively bullish. Analysts like Steph is Crypto highlight the weekly close above the $2.01 resistance level as the key confirmation. This breakout opens the path for a run toward the next major target at $2.50. This technical optimism aligns perfectly with fundamental forecasts, including Standard Chartered’s bold prediction of a 330% upside for XRP.

My Thoughts

This isn’t just a temporary pump. Flipping a giant like BNB is a statement. It represents a massive vote of confidence from the market, finally moving past years of regulatory overhang. The combination of technical structure and institutional flow is incredibly potent. While some ETF issuers have paused plans, the existing product demand combined with this technical breakout suggests XRP is rewriting its narrative. This could mark the beginning of a sustained re-rating as capital rotates into this rejuvenated asset.