XRP Price Prediction: A Sideways Grind Before a 2026 Breakout?

Get ready for a game of patience. According to top analysts, XRP might continue its consolidation into the new year before powerful catalysts align for a potential surge in the second half of 2026. Our XRP price prediction isn’t about a quick pump; it’s about strategic positioning for when macro conditions and fundamental developments finally converge to propel this digital asset forward. Let’s dive into the timeline and triggers.

Analyst Outlook: Near-Term Caution, Long-Term Constructive

The consensus among experts is a “slightly bearish tilt” on altcoins in the short term, contingent on Bitcoin finding a solid bottom. This suggests XRP could see more sideways or downward pressure initially.

However, the horizon brightens significantly later in 2026. Analysis points to “more constructive conditions for risk assets” in the latter half of the year. For XRP specifically, this bullish shift could be supercharged by major catalysts, including deeper integration into global payment rails and evolving efforts to position XRP as a premier liquidity bridge asset.

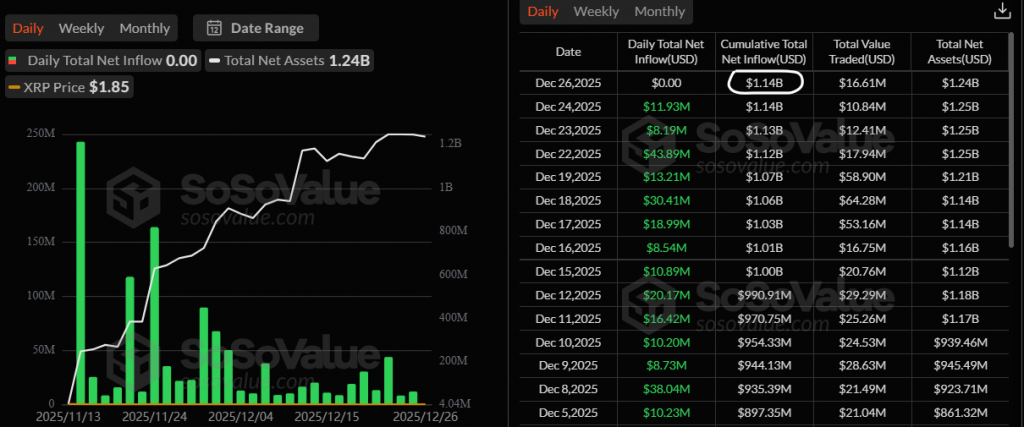

The Bullish Elephant in the Room: Unstoppable ETF Inflows

Here’s the most compelling data point contradicting the current price action: U.S. spot XRP ETFs have surpassed $1 billion in assets with zero days of net outflows since launch. This is monumental. It means institutional capital is steadily accumulating XRP through a regulated wrapper, building a massive foundation of demand that currently overshadows retail selling pressure.

This “smart money” accumulation during a price slump is a classic bullish divergence. It suggests institutions are betting on the long-term narrative while trading the short-term weakness.

Key Catalysts to Watch in 2026

For our XRP price prediction to materialize, watch these developments:

- ETF Growth & Potential New Approvals: Expansion of the current ETF suite or approvals in new regions.

- Payment Rail Integration: Concrete progress on Ripple’s strategy to embed XRP in cross-border settlements.

- Liquidity Bridge Role: Increased adoption of XRP as a neutral bridge asset in DeFi and institutional finance.

- Broader Crypto Market Recovery: A definitive end to the Bitcoin consolidation, which would lift the entire altcoin market.

My Thoughts

This is a quintessential “see through the noise” setup. The relentless XRP ETF inflows are the alpha signal most are missing. While the price chart looks ugly, institutions are building a war chest. My XRP price prediction aligns with the analysts: accumulate during this weakness with a 12-18 month horizon. The second half of 2026 could see a perfect storm of regulatory clarity, product maturity, and a bullish macro cycle that finally unleashes XRP’s long-deferred run.