XRP has taken a hit, retreating 23% from its yearly high to trade around $2.81. While the short-term momentum has stalled, a powerful combination of booming ecosystem growth and surging institutional demand suggests this dip is a prime buying opportunity before a significant September rebound.

RLUSD Stablecoin Is Booming

The most compelling bullish signal comes from Ripple’s stablecoin, RLUSD. Its growth has been nothing short of explosive.

- Record Supply: RLUSD’s supply soared to a record $701 million, crossing the $700M milestone.

- Rapid Adoption: This growth is stunning when compared to PayPal’s PYUSD, which took two years to reach $1.1 billion.

- Increasing Utility: Daily transaction volume and usage (like in the Bullish IPO) are also surging.

This massive adoption directly boosts the utility and value of the XRP Ledger, creating a stronger fundamental case for the XRP token itself.

Wall Street Demand Is at a Record High

Institutional interest is also hitting unprecedented levels, a classic precursor to a major price move.

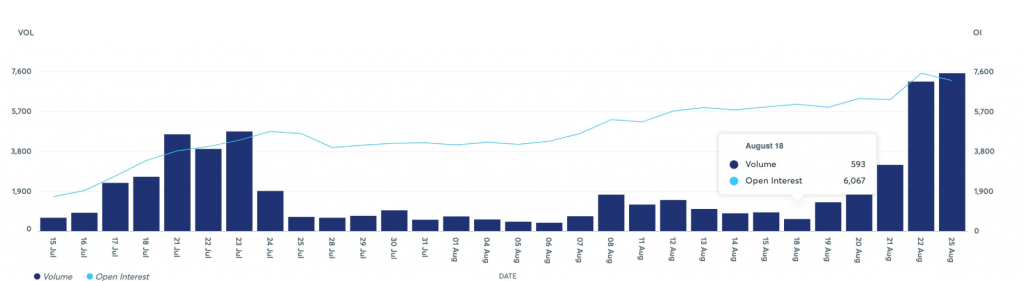

- CME Futures: The open interest for XRP futures on the Chicago Mercantile Exchange (CME) has rocketed to a record $1 billion. This is the fastest any contract has reached this milestone, achieving it in just three months.

- ETF Success: The Teucrium 2X Long Daily XRP ETF (XXRP) has seen inflows every single month since its launch and now holds over $352 million in assets.

This data strongly suggests that U.S. investors are eagerly awaiting the eventual approval of a spot XRP ETF, which could happen as soon as September.

XRP Price Technical Analysis: The Bullish Pennant

The chart reveals a highly optimistic technical setup. Despite the pullback, XRP has held firmly above the 100-day Exponential Moving Average (EMA), a key sign that bulls are still in control.

More importantly, the price action has formed a bullish pennant pattern. This pattern, which looks like a small symmetrical triangle following a sharp vertical rise, is typically a continuation signal.

A successful breakout from this pattern could propel XRP back to its yearly high of $3.6640—a 30% gain from current levels. A break above that resistance could then open the door to a run toward $5.

The Bottom Line

The narrative for XRP is incredibly strong. The combination of RLUSD’s rapid adoption, record institutional demand on the CME, and a bullish technical pattern creates a powerful case for a significant rebound. For investors, the current dip may represent a strategic entry point before the next leg up, especially with a potential spot ETF approval on the horizon.