This weekend delivered a tale of two cryptocurrencies. While Ethereum surged over 10% to smash its all-time high near $4,900, Bitcoin struggled to break past $117,000. This divergence left many investors wondering: why did BTC miss the rally? On-chain data and market metrics point to three clear reasons for Bitcoin’s underwhelming performance.

1. Weak Institutional Demand on Coinbase

A key indicator of U.S. institutional appetite, the Coinbase Premium Index, fell to its lowest level since August 1. This metric measures the price difference between Coinbase Pro (institutional-heavy) and Binance (retail-heavy).

When it trends near zero, it signals a critical problem: American whales aren’t buying. The data suggests that while retail traders were active, the large corporate investors who typically drive major Bitcoin rallies remained on the sidelines this week. Their hesitation created a significant lack of buying pressure at a crucial time.

2. Bitcoin ETFs Saw a Full Week of Outflows

The story from the ETF market was even more telling. For the entire week, Bitcoin ETFs failed to record a single day of net inflows.

- Bitcoin ETFs: $1.2 billion in outflows over 6 consecutive days.

- Ethereum ETFs: $337 million in inflows on Friday alone.

This massive divergence shows a clear rotation of capital from Bitcoin into Ethereum and other altcoins following Fed Chair Powell’s dovish comments. Without the steady support of ETF inflows, Bitcoin’s price ascent lacked its most powerful engine.

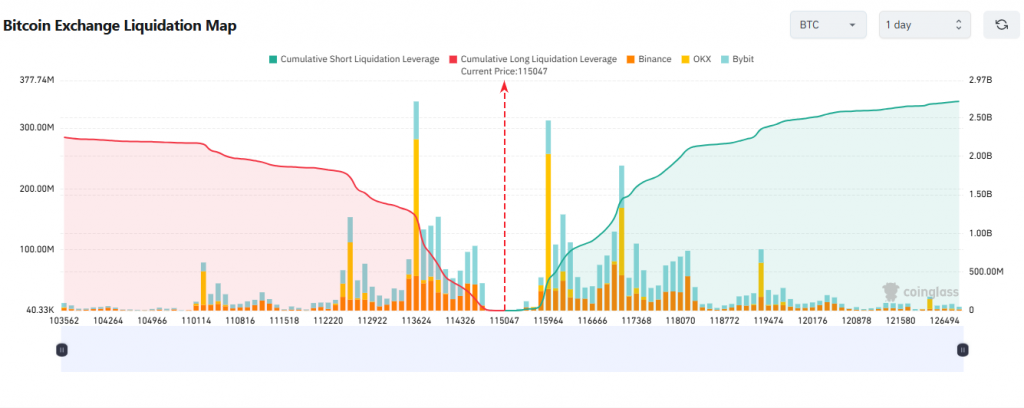

3. A Massive $3 Billion Resistance Wall

Derivatives data reveals a formidable barrier. A $3 billion cluster of short positions is concentrated at the $117,800 price level. This represents nearly half of all active downside bets.

This creates a powerful incentive for traders to sell at that level to protect their short positions, effectively creating a ceiling. Bitcoin’s rejection from its intraday high of $117,370 aligns perfectly with this resistance wall, showing how derivative markets can actively cap price growth.

Bitcoin Price Prediction: What’s Next?

Given these three headwinds, a clean break above $120,000 seems unlikely in the immediate term without a fresh catalyst.

- Bullish Scenario: A decisive close above $118,000 could trigger a short squeeze, potentially propelling BTC toward $123,000.

- Bearish Scenario: If Bitcoin fails to hold $113,500 as support, a retracement toward $110,000 becomes likely.

For now, Bitcoin appears poised to consolidate between $113,500 and $118,000 until institutional demand returns or the massive resistance wall is broken.