The Tension at $90,000: Is the Bitcoin Breakout Finally Here?

The pressure is building at a critical level. Bitcoin surged over 2% during Asia trading, pushing relentlessly toward the psychological $90,000 barrier. This move comes as gold and silver shatter yet another all-time high, creating a powerful macro backdrop. Today’s focus, however, is on a monumental catalyst: a nearly $24 billion Bitcoin options expiry. This event is poised to dismantle the derivatives mechanics that have trapped price action for weeks, potentially unleashing the next major Bitcoin breakout.

The $24B Options Expiry: The Key to Unlocking Volatility

For weeks, “gamma” from options dealers has artificially suppressed volatility, creating a tight range. As trader BitBull notes, this hedging pressure has made price action inorganic. Today’s massive expiry changes everything.

“As these contracts roll off, the hedging pressure that’s been keeping price compressed starts to disappear,” BitBull explained. “After that, price action reflects real positioning again, not derivatives mechanics.” This reset could be the clean slate Bitcoin needs to establish a clear directional trend, with the bias leaning bullish given the structure of the expiring contracts.

Macro Backdrop: Precious Metals Soar as Crypto Awaits Its Turn

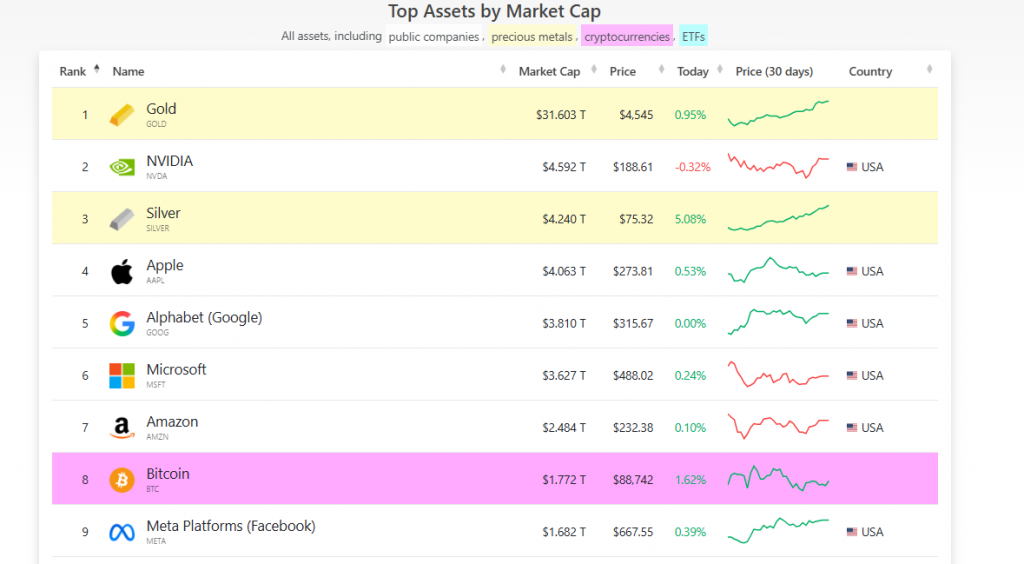

While Bitcoin consolidates, traditional safe havens are racing ahead. Gold and silver continue their historic bull runs, with silver now the world’s third-largest asset by market cap, surpassing Bitcoin. This divergence highlights a risk-off capital rotation, but analyst Michaël van de Poppe sees it as a setup for crypto.

“January is a period where asset managers are reallocating… For sure, nothing in commodities, they are well due for a correction… mostly, it’s Crypto and Bitcoin,” he argued, suggesting crypto is “significantly undervalued and mispriced” for a major reallocation.

Technical Outlook: The Path for a Confirmed Bitcoin Breakout

The daily chart shows Bitcoin attempting to escape a two-month downtrend. The immediate battle is for a daily close above key resistance. Analyst Crypto Ideology states, “The daily close is key. A confirmed Bitcoin breakout opens a move toward $95k.”

The 50-day moving averages near $91.5K provide the next major resistance. A decisive reclaim of this zone would signal a strong shift in momentum and open a path toward $100,000. Until then, the market remains in a high-stakes range.

My Thoughts

The setup is compelling. The options expiry is a known mechanical catalyst that often resolves the very compression it creates. With a bullish skew in the contracts and Bitcoin coiling at range highs, the conditions for an upside resolution are strong. The precious metals rally proves capital is seeking hard assets; it’s only a matter of time before that liquidity spills into the digital hard asset. My expectation is a grind toward $95K post-expiry, with a true trend confirmation above the 50-day MA. This could be the start of Q1’s rally.