Bitcoin shocked investors with a violent correction, plummeting to $108,000 after failing to break above key resistance. The sudden drop sent shockwaves through the market, breaking crucial support levels. Surprisingly, this sell-off coincided with a major reversal in ETF flows, ending a worrisome six-day streak of outflows.

A Surprising End to the ETF Outflow Streak

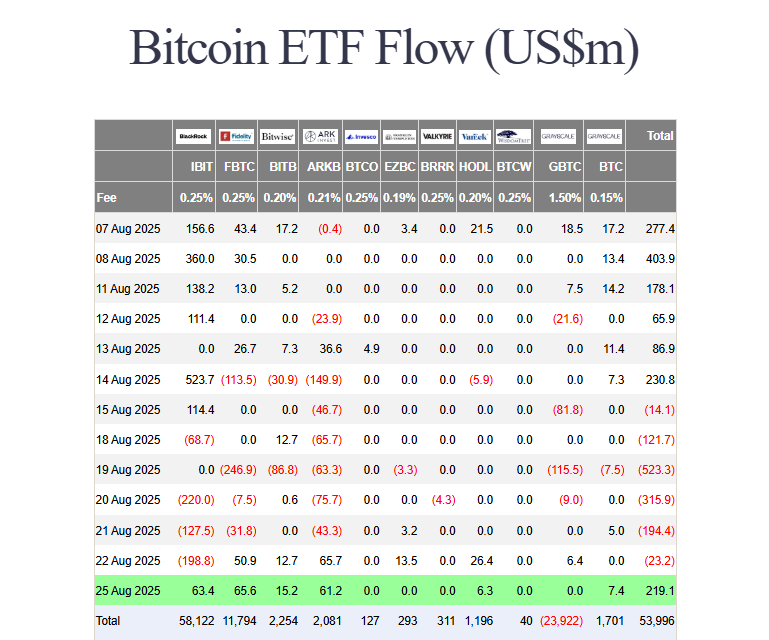

The narrative took an unexpected turn on Monday. After six straight days of withdrawals—the longest streak since April—spot Bitcoin ETFs recorded a collective $219 million in inflows.

- Fidelity’s FBTC led the charge with $65 million in new capital.

- BlackRock’s IBIT followed closely with $63.38 million.

- Crucially, none of the twelve funds reported outflows.

This suggests that large institutions and perhaps confident retail traders saw the dip as a major buying opportunity, potentially positioning for a rebound.

A Dangerous Divergence in the Derivatives Market

While ETFs saw inflows, the derivatives market painted a riskier picture. Data from CryptoQuant revealed a worrying trend: despite Bitcoin’s price decline, funding rates remained persistently positive.

This means leveraged traders continued to open new long positions, betting aggressively that the drop was temporary. This creates a precarious situation; if the price continues to fall, it could trigger a massive long squeeze, forcing these traders to sell and accelerating the downturn.

Bitcoin Price Analysis: Key Levels for the Next Move

Technically, Bitcoin has broken down from an ascending triangle pattern, confirming bearish momentum in the short term.

- Key Support Levels: The immediate floor is $108,000. A break below this opens the door to $105,000 and potentially $100,000.

- Key Resistance Levels: For any hope of a bullish reversal, BTC must reclaim $117,800 and then $121,300.

Momentum indicators currently favor sellers. The RSI is weak at 38.2, and the Chaikin Money Flow is negative, confirming that capital is flowing out of Bitcoin.

The Bottom Line

The market is at a critical juncture. The return of ETF inflows is a strong bullish counter-signal amidst the panic. However, the overheated derivatives market and broken technical structure suggest caution.

If Bitcoin can hold $108,000, it could form a base for recovery. However, a break below this level could quickly unleash a wave of liquidations toward $100,000. For now, the path of least resistance appears to be down until buyers can force a decisive reclaim of the $117,800 level.