Bitcoin surprised traders with a sharp 3% drop, falling below the crucial $110,000 support level to a low of $109,427. The move caused Bitcoin to break below both its 20-day and 50-day Exponential Moving Averages (EMAs), raising concerns about a deeper correction. However, despite the short-term panic, the long-term institutional outlook remains incredibly bullish.

Key Technical Levels to Watch

The sudden sell-off has traders closely watching the charts. Technical analyst Captain Faibik notes that Bitcoin is still moving within a descending channel on the 4-hour chart.

- Critical Support: The $107,000 zone is now the key level to hold. If it bounces from here, a reversal toward $116,000 is possible over the weekend.

- Resistance: The upper boundary of the channel aligns with the $116,000 area, making it the next logical target for any rebound.

The price action is at a critical juncture, and holding $107K is essential for the bullish thesis to remain intact in the near term.

Liquidations Wiped Out $411M

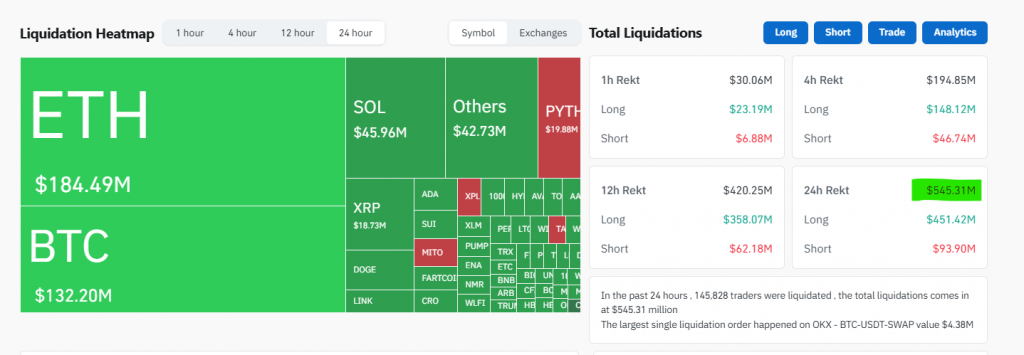

The drop was exacerbated by a massive wave of liquidations. Data from CoinGlass shows that over $411 million in leveraged positions were liquidated in the past 24 hours.

- Long Liquidations: $351 million of the wiped-out positions were from traders betting on higher prices.

- Recent Pressure: In just the past hour, $60 million in long positions were liquidated.

This suggests the rapid decline caught many bullish traders by surprise, accelerating the downward move.

Why Institutions Are Still Bullish Long-Term

While traders focus on the short-term dip, institutions are looking years ahead. Crypto asset manager Bitwise released a report projecting that Bitcoin could reach $1.3 million by 2035.

This projection is based on a 28.3% compound annual growth rate (CAGR). The firm emphasizes that future growth will be driven by institutional demand, not retail speculation.

Their model includes:

- Bullish Scenario: $2.97 million by 2035

- Bearish Scenario: $88,005 by 2035

This long-term confidence suggests that current dips are viewed as buying opportunities by large, sophisticated players.

The Bottom Line

Bitcoin is currently testing a critical technical support level. While the short-term trend is shaky, the long-term narrative powered by institutional adoption has never been stronger. For investors, this dip could represent a potential entry point before the next leg up, especially if the $107,000 support holds firm.