The Ultimate HODL Signal: Bitcoin ETF Flows Defy Negative Returns

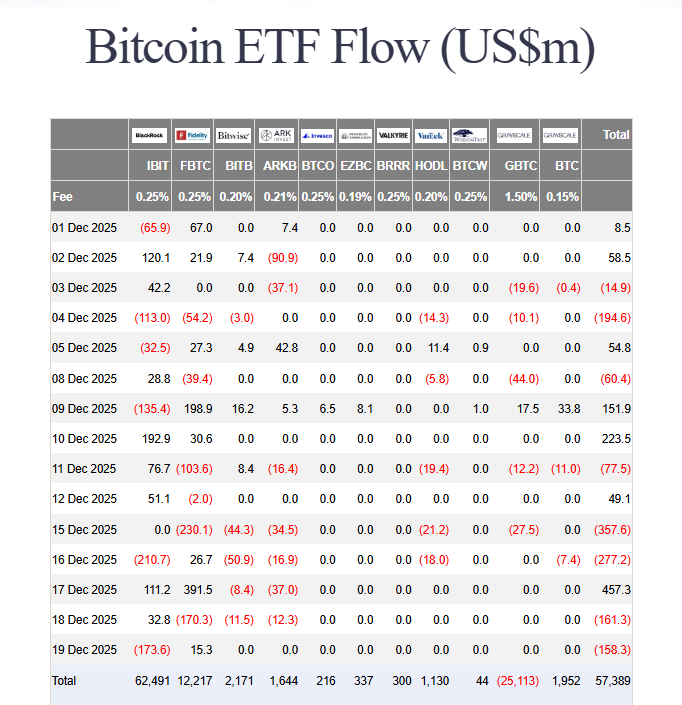

Here’s a stunning fact that changes the entire institutional narrative. While crypto Twitter fixates on price, a deeper story is unfolding. BlackRock’s iShares Bitcoin Trust (IBIT) ranks as the sixth-highest ETF for inflows in all of 2025, raking in over $25 billion. The shocking part? It’s the only ETF in the top 25 with a negative year-to-date return. This isn’t fair-weather investing; this is a masterclass in conviction. Let’s break down why these Bitcoin ETF flows are massively bullish.

Institutions Are Teaching a “HODL Clinic”

Bloomberg ETF analyst Eric Balchunas spotlighted this incredible data. Among giants like Vanguard’s S&P 500 ETF ($145B inflows), IBIT stands out not for its performance but for its steadfast inflows despite a 9.6% loss. Even the gold ETF (GLD), up 65%, attracted less money.

This demolishes the idea that ETF investors are weak-handed momentum chasers. Instead, they’re displaying diamond-handed behavior typically associated with crypto natives. They’re building a strategic, long-term position, not trading short-term volatility. As Balchunas put it, “boomers [are] putting on a HODL clinic.”

The Bullish Long-Term Implication: Imagine the Floodgates

The real alpha here isn’t about today’s price. It’s about future potential. The data reveals a profound truth: Bitcoin ETF flows have incredible staying power even in a down year.

Think about the logic. If IBIT can pull in $25 billion during a corrective period, what happens when Bitcoin enters a clear, sustained bull market? The flow potential becomes astronomical. This establishes a formidable, buy-the-dip floor of institutional demand that simply didn’t exist before 2024.

A Paradigm Shift in Institutional Behavior

This trend signifies a maturity in the institutional approach to Bitcoin. It’s no longer a speculative trade; it’s a strategic portfolio allocation. The consistent inflows amid negativity suggest these are multi-year allocations from pensions, endowments, and sovereign wealth funds—capital that moves slowly but inexorably.

My Take

This is the most bullish on-chain data for traditional finance. Price is noise; flows are signal. The institutional foundation being laid here is rock solid. When the macro winds shift and Bitcoin breaks to new highs, this persistent, drip-fed demand will turn into a tidal wave. It means the next bull run will be structurally different—and potentially bigger—because of this relentless, return-agnostic accumulation. Don’t look at the chart; look at the custody ledger.