The institutional mood is shifting dramatically. Despite Bitcoin falling roughly 13% this week, U.S. spot Bitcoin ETF inflows have surged to $311.6 million, nearly erasing the entire previous week’s outflows. This powerful three-day inflow streak signals that major players are treating the dip as a strategic buying opportunity, not a reason to exit. A potential trend reversal is brewing.

Analyzing the Resurgent Bitcoin ETF Inflows

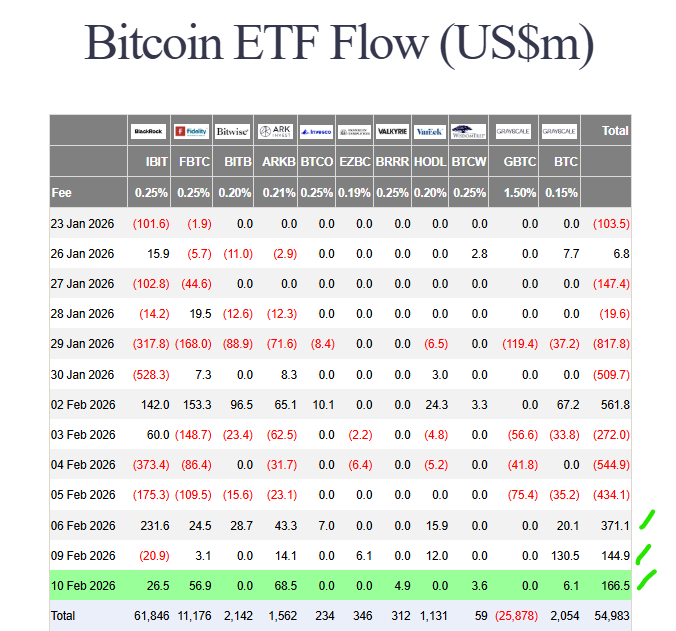

The data tells a compelling story. After three brutal weeks of over $3 billion in combined outflows, the tide has turned. Tuesday alone saw $166.6 million enter these funds. This buying pressure emerged even as BTC price briefly slipped below $68,000, highlighting a clear divergence: weak price action is being met with strong institutional demand.

Analyst Eric Balchunas puts this resilience in perspective. He estimates that only about 6% of total ETF assets exited during the downturn, meaning the vast majority of institutional capital held firm. This is the foundation for a strong recovery.

Goldman Sachs Rotates: Trims BTC, Adds XRP & Solana ETFs

In a parallel development, Goldman Sachs revealed a major portfolio rotation in its Q4 2025 13F filing. The investment bank trimmed its Bitcoin ETF exposure, notably reducing its BlackRock IBIT position by 39%. However, this wasn’t a full retreat from crypto; it was a reallocation.

Goldman disclosed its first-ever purchases of XRP and Solana ETFs, acquiring positions worth $152 million and $104 million respectively. This move signals that sophisticated institutions are beginning to diversify within the digital asset ecosystem, seeking alpha beyond Bitcoin.

My Thoughts

This is a critical inflection point. The return of sustained Bitcoin ETF inflows during price weakness is one of the most bullish signals an institutional market can give. It shows conviction over capitulation. Combined with Goldman’s strategic rotation into altcoin ETFs, it reveals a maturing institutional playbook: Use BTC as a core holding and allocate to select altcoins for growth. This flow data suggests the heavy institutional selling is exhausted. If inflows continue, they will provide the fuel for Bitcoin’s next leg up, with altcoins like XRP and SOL poised to benefit from the spillover of professional capital.