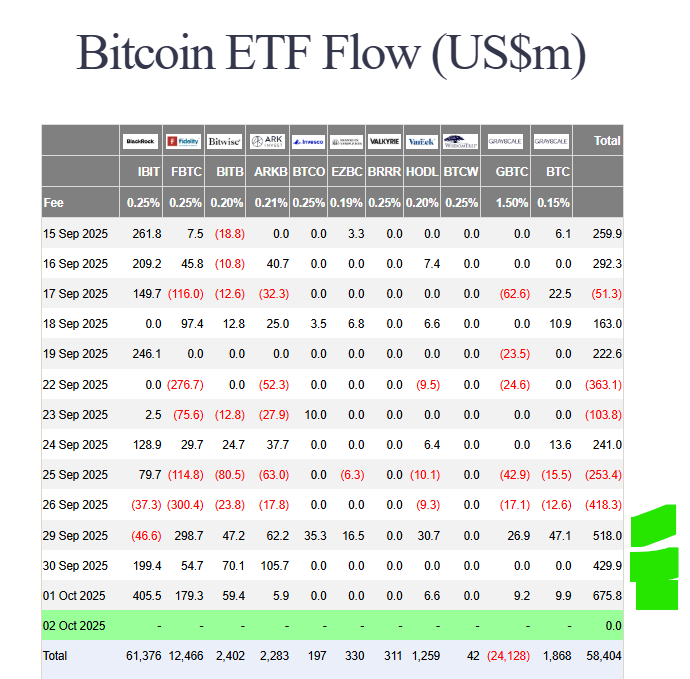

nstitutional demand for Bitcoin has roared back. On Wednesday, Bitcoin ETF inflows reached a massive $676 million, marking the highest single-day total since mid-September and being the third day in a row . Consequently, this buying pressure helped propel the Bitcoin price above $119,000.

Breaking Down the Massive Bitcoin ETF Inflows

The recent Bitcoin ETF inflows were led by the industry giants. Specifically, BlackRock’s IBIT attracted $405.5 million, while Fidelity’s FBTC brought in $179.3 million.

This impressive haul extends a strong three-day streak, signaling a powerful reversal from the outflows seen at the end of last week. Meanwhile, Ethereum ETFs also saw substantial interest, adding $80.9 million on the same day.

Why Institutional Money Is Returning

According to analysts, this wave of Bitcoin ETF inflows is driven by macroeconomic shifts. Primarily, market expectations for a Federal Reserve interest rate cut in October have surged.

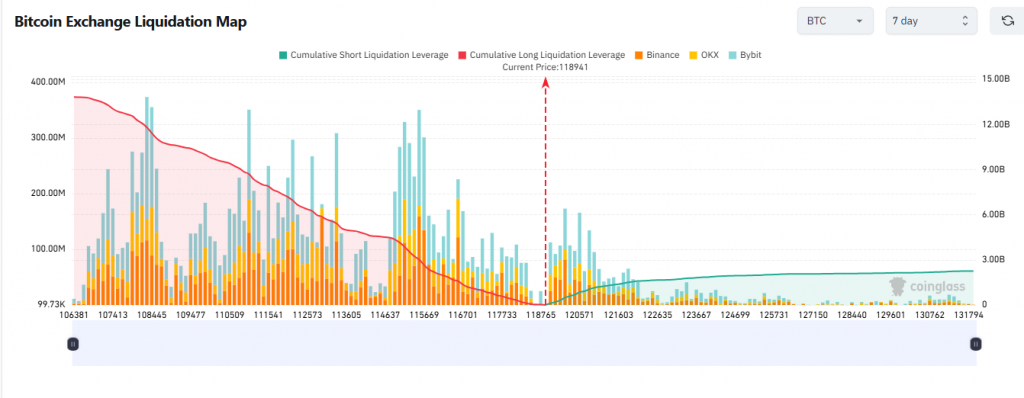

I think that the breakout zone will be $130K as it will trigger a $1.5B short squeeze that could supercharge Uptober.

We should also Highlight that $3.6T JPMORGAN SAID BITCOIN is undervalued compared to Gold and can hit $165K.

The Bottom Line

Ultimately, the resurgence of BTC ETF inflows demonstrates that institutional investors are once again using these funds as a key gateway into the crypto market. As long as macroeconomic conditions remain favorable, this renewed demand could continue to support higher prices.