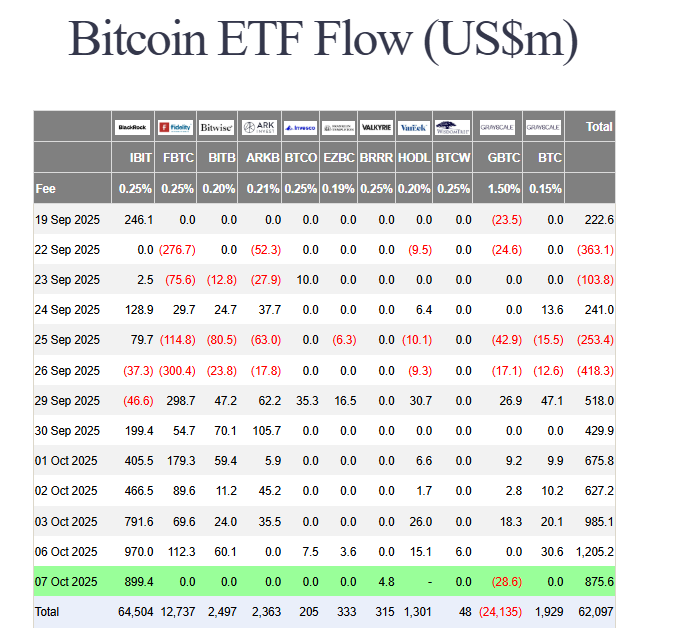

In a stunning show of institutional conviction, Bitcoin ETF inflows have defied the recent price dip, pouring another $876.5 million into the funds on October 7. This marks the seventh consecutive day of positive flows, bringing the total haul over this bullish streak to over $5.3 billion. While Bitcoin’s price faced a minor rejection at the $124,000 resistance level, the big money is clearly seeing this as a buying opportunity, not a reason to flee.

BlackRock Dominates The Bitcoin ETF inflows

The story, as often is the case, was dominated by a single player. BlackRock’s IBIT ETF was the undisputed champion, single-handedly attracting a massive $899.4 million in fresh capital. Valkyrie’s BRRR followed distantly with $4.8 million. The only blemish was a $28.6 million outflow from Grayscale’s GBTC, which was more than offset by the colossal inflows elsewhere. This consistent demand, even during a cooldown, signals that institutions are playing a long-term game, using dips to accumulate.

A Healthy Correction, Not a Trend Reversal

From a technical perspective, this pullback looks more like a healthy breather than a bearish reversal. Bitcoin is currently trading around $122,392, down a modest 1.5% on the day. Crucially, key momentum indicators are resetting perfectly. The RSI has cooled from overbought territory to a balanced 63, while the MACD remains firmly in bullish alignment.

The $120,000 psychological level is now the key support to watch. A hold above it keeps the bullish structure intact for a potential rebound toward $126,000. However, a break below $119,500 could trigger a deeper flush toward the $116,000-$117,000 support zone.

My Thoughts

This is exactly what you want to see in a strong bull market: price dips are met with institutional buying, not panic selling. The relentless Bitcoin ETF inflows are creating a formidable floor of demand. This doesn’t mean we can’t go lower, but it significantly reduces the probability of a deep, sustained crash. The path of least resistance remains upward as long as these flows continue.