Institutional Brakes Slammed: Bitcoin ETF Inflows Crash Amid Regulatory Panic

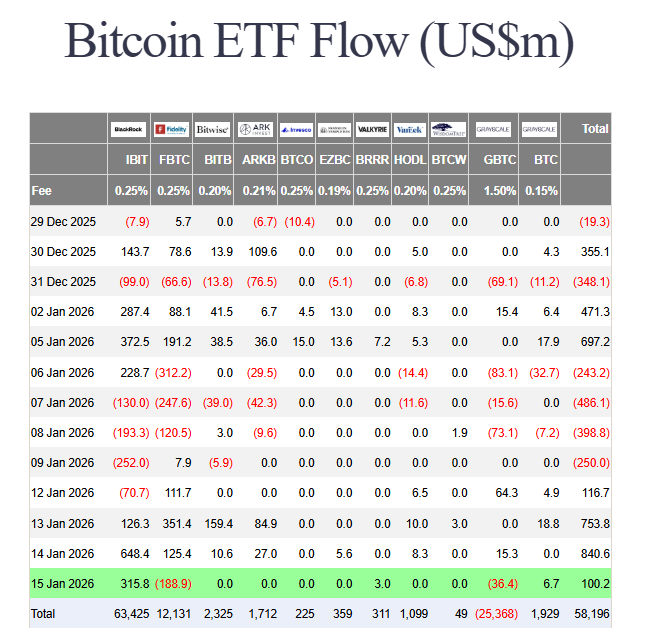

Just like that, the institutional frenzy hit a wall. U.S. spot Bitcoin ETF inflows cratered by a staggering 88% in a single day, falling from $843.6 million to just $100.1 million. This dramatic slowdown wasn’t driven by macroeconomics or price—it was pure regulatory fear. The sudden chill came as industry leaders, including Coinbase CEO Brian Armstrong, raised alarm over restrictive language in a key Senate market structure bill, causing the planned committee vote to be abruptly canceled.

The flow data tells the story of a divided institutional response. BlackRock’s IBIT stood firm, attracting a solid $315.7 million. However, this was massively offset by outflows from Fidelity’s FBTC ($188.8M) and continued selling from Grayscale’s GBTC. The message is clear: while some institutions are steadfast, others hit the “sell” button at the first sign of regulatory uncertainty, proving that political risk remains a primary driver for short-term capital.

Bullish Structure Holds Despite Faltering Bitcoin ETF Inflows

Despite the panic selling, the technical picture tells a different, more resilient story. Bitcoin confirmed a breakout from a bullish ascending triangle pattern on the daily chart before this pullback. This classic continuation structure suggests the underlying trend is still strong. Key momentum indicators like the RSI and MACD remain in positive territory, indicating buyers are still in control.

The immediate battleground is the psychological $95,000 support level. If bulls defend this zone, the triangle breakout target—significantly higher than current prices—remains in play. The Fear & Greed Index dropping back to “Neutral” (49) from “Greed” actually sets up a healthier foundation for the next leg up, having flushed out the weak hands.

My Thoughts

This is a temporary political speed bump, not a roadblock. The market overreacted to procedural delays—this is how messy democracy works. The key takeaway is that the underlying institutional demand is real (BlackRock kept buying), and the technicals are intact. This pullback is a gift for those who understand that regulatory clarity is a process. Once the political noise settles, the massive ETF infrastructure that just absorbed this sell-off will be the same pipeline that fuels the next rally. Keep your eyes on $95K.