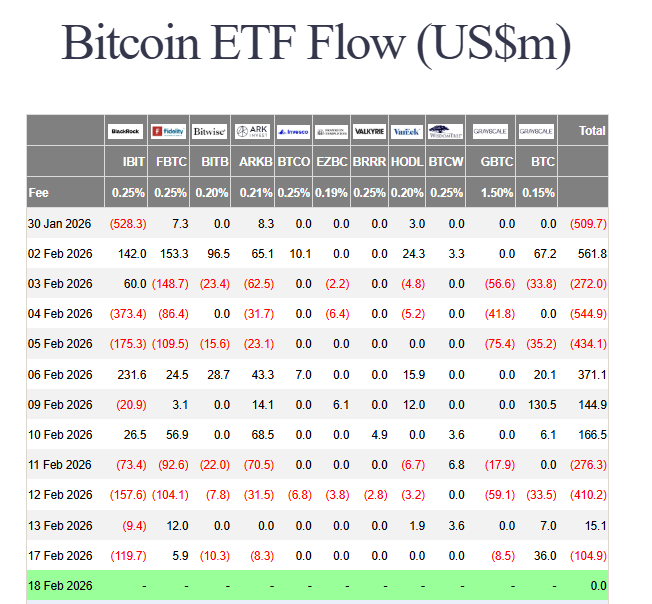

The Q4 2025 13F filings are in, and they’re revealing fascinating shifts in Bitcoin ETF institutional holdings. While spot Bitcoin ETFs posted another day of outflows ($104.9 million) and trading volume cratered 80% from its peak, the real story is who was buying—and selling—during one of crypto’s most volatile quarters.

Bitcoin ETF Institutional Holdings: The Mystery Buyer

The most intriguing disclosure comes from a previously unknown entity: Laurore, a Hong Kong-based company with zero digital footprint, purchased $436.2 million of BlackRock’s IBIT in a single transaction. The only named contact is “Zhang Hui”—the Chinese equivalent of John Smith.

Bitwise’s Jeff Park speculates this could be the first sign of institutional Chinese capital entering Bitcoin via ETFs, potentially signaling capital flight or strategic accumulation. Skeptics question why an ETF was chosen over direct BTC purchases, but the sheer size demands attention.

The Big Buyers and Sellers

Beyond the mystery, established players made significant moves:

- Jane Street emerged as the second-largest IBIT buyer in Q4, adding $276 million.

- Weiss Asset Management added ~$107.5 million.

- 59 North Capital increased by ~$99.8 million.

- Abu Dhabi’s Mubadala Investment boosted holdings 45% to $630.7 million.

On the sell side:

- Brevan Howard slashed IBIT holdings by 85% , from $2.4B to $273.5M.

- Goldman Sachs trimmed 40% , leaving ~$1B in assets.

Outflows Slow, Volume Drops

Tuesday’s $104.9M outflow extends the recent trend of slowing redemptions. More striking: daily trading volume fell to just over $3 billion, down nearly 80% from the $14.7B peak on February 5. This suggests the panic selling phase may be exhausting itself.

My Thoughts

This batch of Bitcoin ETF institutional holdings data tells a story of diverging conviction. Some institutions (Brevan Howard, Goldman) took profits or cut risk. Others (Jane Street, Mubadala) added size. And then there’s Laurore—a ghost entity moving nearly half a billion dollars.

The Laurore filing is the kind of data point that keeps analysts up at night. If this truly represents Chinese institutional capital finding its way into U.S. Bitcoin ETFs, it’s a structural game-changer. It suggests demand channels we haven’t even begun to model.

Meanwhile, slowing outflows and collapsing volume hint at seller exhaustion. The next leg of this market will be determined by whether new buyers—mysterious or otherwise—step in to absorb supply.