The pressure on Bitcoin is intensifying, and the ETF flow data confirms it. Spot Bitcoin ETFs bled $545 million in daily outflows on Wednesday as BTC price threatened to break below the critical $70,000 support level. This pushes weekly flows deep into negative territory, yet a deeper look reveals a surprising story of investor resilience that could define the next market phase.

Analyzing the Latest Bitcoin ETF Outflows

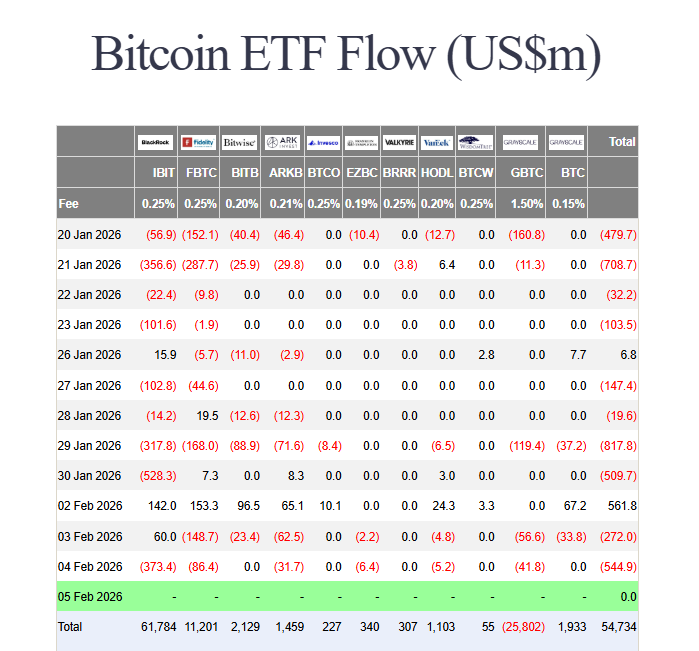

The data from SoSoValue is stark. Year-to-date, these funds have seen $5.4 billion in redemptions against $3.5 billion in inflows, leaving a net deficit of $1.8 billion. Total assets under management have shrunk to $93.5 billion, reflecting the broader 20% pullback in total crypto market cap.

However, context is crucial. Despite the heavy outflows, analysts highlight remarkable holder stamina. Bloomberg’s Eric Balchunas estimates that only about 6% of total ETF assets have exited even as prices have fallen sharply. This suggests the vast majority of institutional capital is treating this as a volatile holding period, not a liquidation event.

The Big Picture: Resilience Over Panic

The cumulative narrative is key. While net flows have retreated 13% from their October peak, $54.8 billion of foundational capital remains. As James Seyffart noted, taking in $63 billion at the peak was extraordinary, and the current hold level is “not too shabby.” This is a market maturing through its first major downturn with these products.

Altcoin ETF flows were mixed, with Ethereum seeing outflows and XRP posting minor inflows, indicating the pressure is not uniform across the digital asset space.

My Thoughts

This is a critical stress test. The Bitcoin ETF outflows are concerning in the short term, but the holder resilience is the real story. It tells us the institutional adoption thesis is intact; this is profit-taking and risk management, not a loss of faith. When weak hands finish selling, this retained capital becomes a powerful base for the next rally. The key level is $70,000—a hold above it, coupled with a slowdown in outflows, would signal the correction is finding a bottom. This is the messy process of a market building a stronger, more mature foundation.